What Is Msme Registration?

MSME registration stands for Micro, Small, and Medium Enterprises registration. The Government of India introduced the MSME Act to support these enterprises through various schemes, incentives, and subsidies. The Ministry of Micro, Small, and Medium Enterprises, a department of the Government of India, oversees this initiative. Banks offer loans at lower interest rates to businesses with MSME registration. MSMEs play a crucial role in the country’s economic growth by contributing to employment, innovation, and overall development.

Benefits Of Msme/ssi Registration

Benefits of MSME/SSI registration are as follows:

Cheaper infrastructure: MSME/SSI registered companies benefit from significantly lower charges for infrastructure services.

Pre-defined objectives or period: A partnership can be formed within a specified period or for a particular project or objective. Once the project is completed, the partnership is automatically dissolved.

Quicker approvals from state and central government bodies: Businesses registered under MSME/SSI receive priority and quicker approvals from government authorities.

Access to tenders: MSME/SSI businesses have access to various government tenders, promoting the growth of small businesses in India.

MSME market development assistance: The government offers assistance to micro and small enterprises by purchasing their products, helping expand their market presence.

Cheaper bank loans: MSME/SSI registered companies enjoy lower interest rates on loans, making financial resources more accessible.

Easy access to credit: MSMEs/SSIs can avail loans without the need for collateral. Additionally, the PM MUDRA loan scheme introduced by PM Modi is highly beneficial for these businesses.

Concession in trademark registration: MSMEs/SSIs receive concessions when registering trademarks, helping protect their intellectual property at reduced costs.

Concession in patent registration: MSME/SSI businesses also benefit from reduced fees for patent registration, encouraging innovation.

Who all are Eligible for MSME Registration?

The following entities are eligible for MSME registration:

- Micro, small, and medium-level business entities that meet the prescribed criteria can apply for MSME registration in India.

- Limited Liability Partnerships (LLP)

- Private Limited Companies (Pvt. Ltd.)

- One-Person Companies (OPC)

- Proprietorship firms

- Public companies can also apply for MSME registration.

Additionally, both manufacturing and service sector companies are eligible for MSME registration.

Any entity with a valid Aadhar Number can apply for MSME registration, as an Aadhar Number is mandatory for obtaining the MSME Certificate.

What Businesses Are Categorised Under The Msme Scheme?

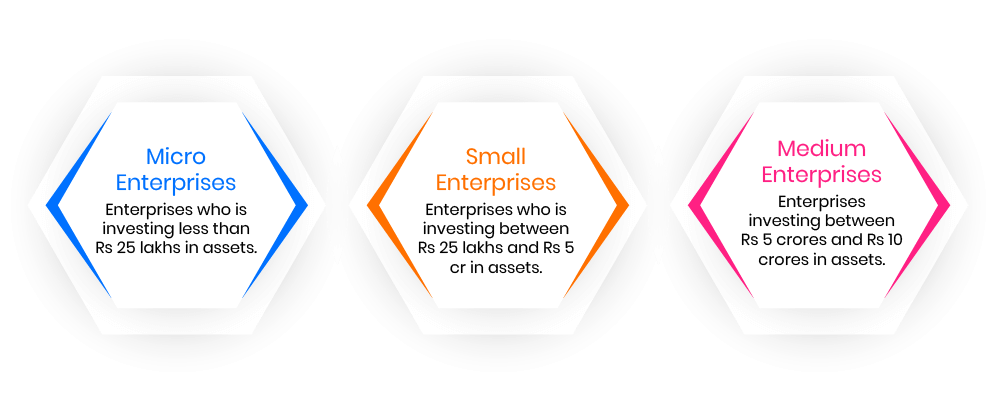

For Manufacturing Sector Amount Invested In Assests

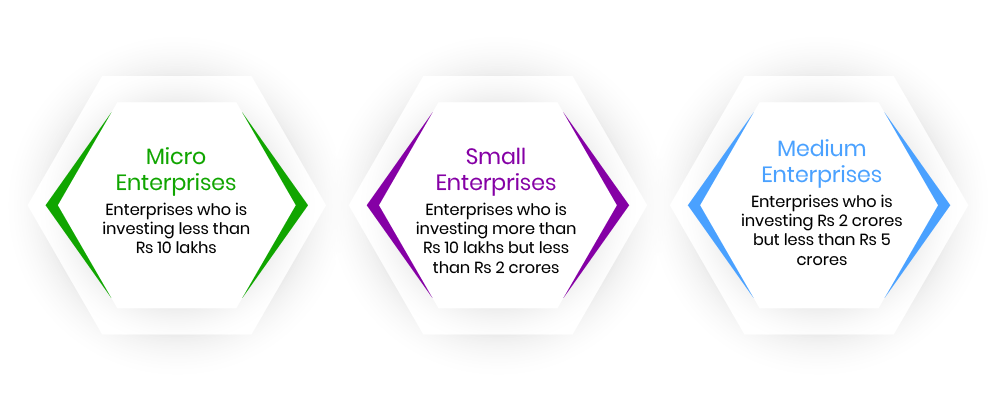

For Service Sector Amount Invested In Equipments

Document Required

For MSME registration, a few documents and personal details of the individual are required. Aadhar Card is compulsory for the registration process.

The following documents are required for MSME registration:

- Aadhar number of the applicant

- Bank account number and IFSC code

- The basic business activity of the enterprise

- NIC 2-digit code

- Investment in plant and machinery/equipment

- MOA (Memorandum of Association) and AOA (Articles of Association)

- Copies of Sales Bill and Purchase Bill

- Name, gender, PAN number, email ID, and mobile number of the applicant

- PAN, location, and address of the organization

- Number of employees and the planned date of starting the business

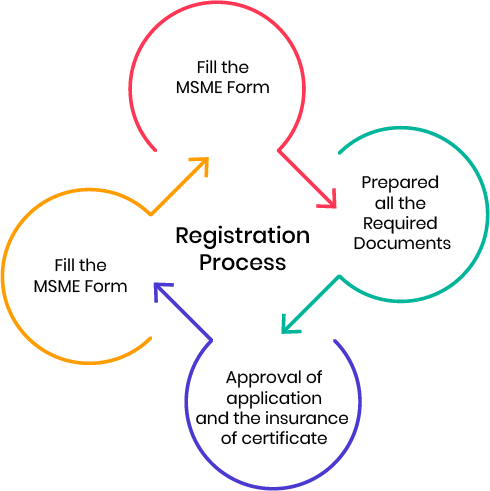

Registration Process

- Fill Application Form:

This is the first step where you need to fill in the necessary details about the individual or business.

- Enter Personal Details:

In this step, you will provide all your personal details, such as name, address, bank account details, and PAN card information.

- Executive Will Process Application:

Once your application is submitted, an executive will review it. If there are any errors or issues, you will be notified for corrections.

- Receive Certificate via Email:

After completing the application, you will receive the MSME registration certificate through email. The Ministry does not issue a hard copy; the certificate will be in virtual format.

How can an Applicant Check MSME Registration Status?

To check the MSME Registration status by reference number and name, follow these steps:

- Step 1:

Visit the MSME Registration portal.

- Step 2:

Enter the 12-digit UAM number and the verification code as shown in the CAPTCHA image.

- Step 3:

After entering the 12-digit UAM number, click on the ‘Verify’ button.

- Step 4:

You will be able to check the status of your MSME Registration.

MSME registration refers to the registration of Micro, Small, and Medium Enterprises. The Government of India introduced the MSME Act to support these businesses through various schemes, incentives, and subsidies. The Ministry of Micro, Small, and Medium Enterprises (MSME) is a branch of the Government of India responsible for promoting and regulating these enterprises

MSME stands for Micro, Small, and Medium Enterprises.

At LegalTax, you can obtain MSME registration for just ₹999.

- Aadhar number of the applicant

- Bank account number and IFSC code

- The basic business activity of the enterprise

- NIC 2-digit code

- Investment in plant and machinery/equipment

- MOA and AOA

- Copies of Sales Bill and Purchase Bill

- Name, gender, PAN number, email ID, and mobile number of the applicant

- PAN, location, and address of the organization

- Number of employees and the planned business start date.

Yes, GST is mandatory for MSME companies.

- Cheaper infrastructure

- Quicker approvals from state and central government bodies

- Access to tenders

- MSME market development assistance for micro and small enterprises

- Cheaper bank loans

- Easy access to credit

- Concession in trademark registration

- Concession in patent registration

Small businesses with 9 or fewer employees, a turnover below a certain threshold, and a balance sheet are considered eligible for certain benefits and registration under applicable schemes.

The validity of an MSME certificate is 5 years.

SSI is a form of registration for MSMEs under the Ministry of Micro, Small, and Medium Enterprises.

Yes, Legaltax will assist you in registering your MSME easily with a simple process.

The MSME databank is a comprehensive database in India.

The number provided by the government at the time of registration is called the MSME registration number.

It is a non-profit organization.

It is a self-declaration format under the MSME, where the applicant certifies its existence, bank details, owner’s Aadhar details, and other required information.

There is n difference between MSME,SSI& Udyog Aadhar.

MSME stands for Micro, Small, and Medium Enterprises, as defined under the MSME Development Act of 2006.

Legal Tax offers MSME application services across all of India.

As per the MSME notification, only the original value is to be considered.

For the Manufacturing Sector, the investment in assets is categorized as follows:

- Micro Enterprises: Enterprises investing less than Rs 25 lakhs in assets.

- Small Enterprises: Enterprises investing between Rs 25 lakhs and Rs 5 crores in assets.

- Medium Enterprises: Enterprises investing between Rs 5 crores and Rs 10 crores in assets.

For the Service Sector, the investment in equipment is categorized as follows:

- Micro Enterprises: Enterprises investing less than Rs 10 lakhs in equipment.

- Small Enterprises: Enterprises investing more than Rs 10 lakhs but less than Rs 2 crores in equipment.

- Medium Enterprises: Enterprises investing between Rs 2 crores and Rs 5 crores in equipment.

Twenty items are reserved for manufacturers in the SSI sector.

This loan is offered to Micro, Small, and Medium Enterprises (MSMEs).