IEC

Get your IEC register

We will help you get your IEC in just 3 days

An Overview

The Import Export Code (IEC) is a 10-digit unique code assigned to an individual or company, required for every import and export operation. To expand business internationally, the first step is to engage in exporting and importing products and services. The government has prioritized trade facilitation to reduce transaction costs and time. Engaging in trade benefits not only the business but also the country as a whole. The IEC is issued by the Directorate General of Foreign Trade (DGFT), and it regulates and monitors foreign trade activities in India. This code is often referred to as the “passport” for import and export businesses, and no import or export can be made without obtaining an IEC.

Import Export Code

The IEC is a 10-digit code issued to individuals or businesses for importing or exporting goods and services. It is allotted by the DGFT under the Ministry of Commerce and Industry, Government of India.

The validity of the IEC is lifetime, meaning there is no need to apply for renewal. Once obtained, the company can carry out all import-export-related activities.

It typically takes 12-15 working days to generate an IEC code after submitting the required documents and making any necessary corrections. An IEC is mandatory for all commercial importers and exporters in India, and businesses without an IEC are not eligible to engage in import or export operations.

Unlike many other government licenses, the IEC does not need to be renewed regularly. However, it is required to update the status of the IEC on the DGFT portal annually.

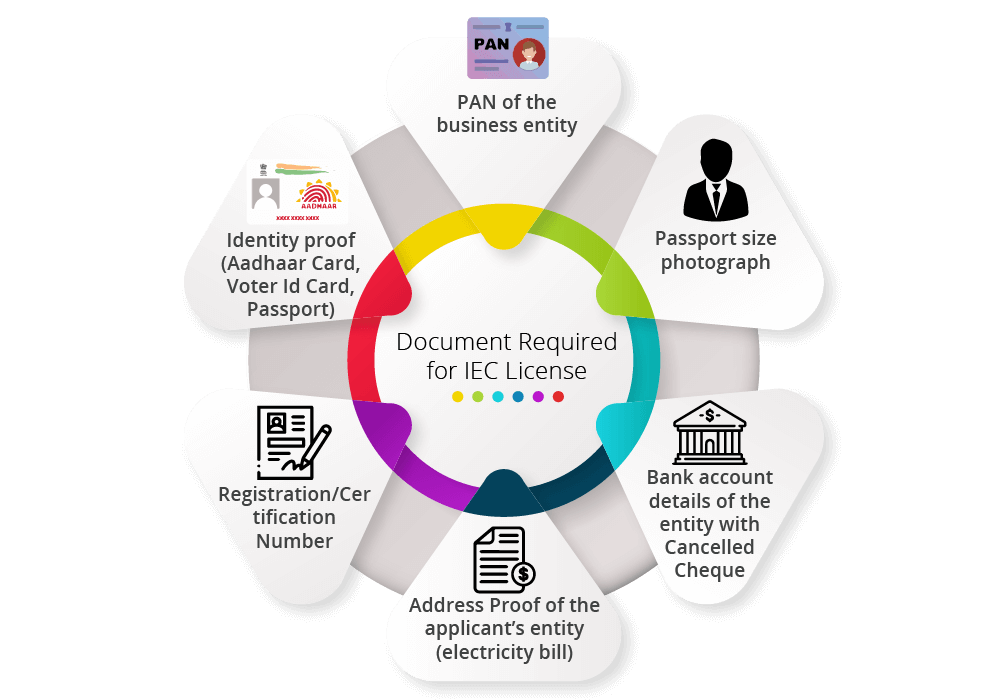

Documents Required for Obtaining IEC License

IEC Registration Process

The first step to obtaining an Import Export License online is the registration process, which can be completed through the government portal of the Directorate General of Foreign Trade (DGFT).

The second step involves uploading the required documents and information to our web portal.

The third step is preparing the application in the prescribed format for the Import Export Code (IEC).

The fourth step is attaching the applicant’s digital signature and filing the online application with DGFT.

The fifth step is the verification process, where DGFT officials will verify and process the application within a week.

Once the application is successfully verified, the Import Export Code certificate will be sent to the applicant via email. This is the final step.

IEC Validity and Renewal

Unlike other government licenses, the Import Export Code previously did not require regular renewal. However, following amendments to the provisions under Chapter 1 and 2 of the Foreign Trade Policy on 12th February 2021, the IEC must now be renewed annually. This amendment made it mandatory for all IEC or e-IEC holders to update their IEC details on the DGFT portal each year, even if there are no changes. This update must be confirmed online.

Why IEC Code License Is Mandatory For Export Service Provider?

The Import Export Code (IEC) is a crucial business identification number required for all export and import operations in India. No business can legally engage in import or export activities without obtaining an IEC code granted by the Directorate General of Foreign Trade (DGFT).

If you are involved in the import or export of services or technology transfer, an IEC code is only required if the service or technology provider seeks benefits under the Foreign Trade Policy or is dealing with specific services or technologies mentioned under Section 7 of the Foreign Trade (Development & Regulation) Amendment Act, 2010.

The DGFT, under the Ministry of Commerce and Industry, issues the IEC registration. For Indian companies looking to expand their business through exports and imports, obtaining IEC registration is mandatory. Without this license, no business can participate in import or export activities. Additionally, the Reserve Bank of India mandates all traders to provide their IEC during any payment transfers related to international transactions.

The government has consolidated several provisions under the Foreign Trade Policy to facilitate import and export trade. For companies aiming for growth and global expansion, obtaining an IEC is essential. It has become mandatory for IEC license holders to renew their registration annually.

In today’s competitive business environment, companies are expanding beyond local markets. With constant innovation and the rise of e-commerce, businesses are increasingly looking to operate globally, making import-export essential for global expansion.

There are various ways to expand internationally, such as through partnerships with foreign brands, opening franchises abroad, establishing subsidiaries, or engaging in import-export. Though the process of going global can be complex, once an IEC is obtained, a business can continue to use it throughout its existence without needing renewal, except for the mandatory annual update.

As globalization continues to surge, cross-border business opportunities are increasing. IEC registration not only helps unlock international business growth but also offers significant advantages in expanding a company’s reach. Having an IEC is crucial for anyone looking to step into the global market, and it significantly contributes to business expansion on a global scale.

Import Export Code Exemption

Certain stakeholders are exempt from the requirement of obtaining an Import Export Code (IEC). These exemptions include:

- Central and State Government ministries or departments.

- Import or export of certain items for personal use that are not related to trade, manufacturing, or agriculture.

- Individuals importing or exporting goods to or from Nepal, Myanmar via Indo-Myanmar border areas, or China, provided the CIF value of a single consignment does not exceed Rs. 25,000. For Nathula port, the exemption ceiling is Rs. 1 lakh.

- Requiremets for Import Export code:

-

Importers and exporters can apply for an Import Export Code (IEC) online. To complete the application process, a Digital Signature Certificate (DSC) of the business owner or director is necessary.

For online IEC code applications, using a Digital Signature (DSC) is the preferred method.

The DGFT offers a unique Digital Signature Certificate (DSC) for organizations that already hold an IEC Code for export and import. Using this unique DSC, applicants can save up to 50% on license fees.

Certificate Of Origin (CO)

A Certificate of Origin (CO) is an essential international business document that certifies the origin of the products in an export shipment. It verifies that the goods were entirely obtained, produced, manufactured, or processed in a specific country.

In essence, the Certificate of Origin declares the product’s “nationality” and serves as a statement by the exporter to comply with customs or trade regulations.

Customs authorities, banks, private entities, and importers require Certificates of Origin for various reasons. Nearly every country requires a CO for customs clearance processes. Hence, IEC Code License holders need to apply for a Certificate of Origin if they plan to export products outside India.

A Certificate of Origin can be issued by the Indian Chamber of Commerce and other authorized bodies. IEC Code License holders can obtain two types of Certificates of Origin:

- Non-preferential Certificate of Origin: This type certifies that the products being exported/imported do not receive preferential tariff treatment, and the applicable duties or charges must be imposed on the items being transported.

- Preferential Certificate of Origin: This certificate is issued for products that qualify for preferential tariff treatment, allowing lower taxes or allowances on goods exported to countries that provide such benefits. These COs are often linked to Regional Trade Agreements.

Benefits Of Import Export Registration

The IEC code registration is the first essential step for any business to export or import goods from India to other countries. This registration opens the door to numerous opportunities for business owners.

Business Expansion:

With IEC registration, businesses can expand globally, allowing them to export goods and products beyond the country’s borders and establish a presence in international markets.

IEC registration also enables businesses to access various benefits provided by the Export Promotion Council, DGFT, and Customs.

No Return Filing

Once the IEC is allocated, there is no need for return filing. The DGFT does not require businesses to file any returns for export transactions, making it a hassle-free process.

Hassle-Free Processing:

Hassle-Free Processing

Obtaining an IEC from the DGFT is simple and can be completed within 10-15 days after submitting the application. No proof of export or import is required after obtaining the IEC registration.

Lifetime Validity:

The validity of an IEC is for a lifetime. There is no need for renewal, and businesses can enjoy its benefits for as long as they operate.

The Import Export Code serves as a government-issued identity number from the DGFT, which can be used for shipment clearance and other export/import activities.

Why To Choose Legal Tax For Import Export Registration?

FAQ’s