Income Tax Filing in India

Let our tax experts handle tax-filing for you. Just update your documents. They will prepare and file your tax returns for you. It’s that simple.

How to Start a Income Tax Return Filing in India

Step 1

Make Enquiry

Share your content details and receive free consultation

Step 2

Submit Documents

Submit documents for your order using online dashboard

Step 3

Make Payment

Make online or offline payment for your order

Step 4

Work Completed

Work will be completed by us and updates delivered online

An Overview of Income Tax Return

Filing an income tax return is a term that most people are familiar with. If you have diligently filed your taxes in the past, you may have received a tax refund, which is determined based on the financial details you provided in your submissions.

Sections 237 to 245 of the Income Tax Act outline the provisions related to tax refunds. A taxpayer can claim an income tax refund if the taxes paid exceed their actual tax liability. This excess payment can arise from advance tax, self-assessment tax, tax deducted at source (TDS), tax collected at source (TCS), or foreign tax credit.

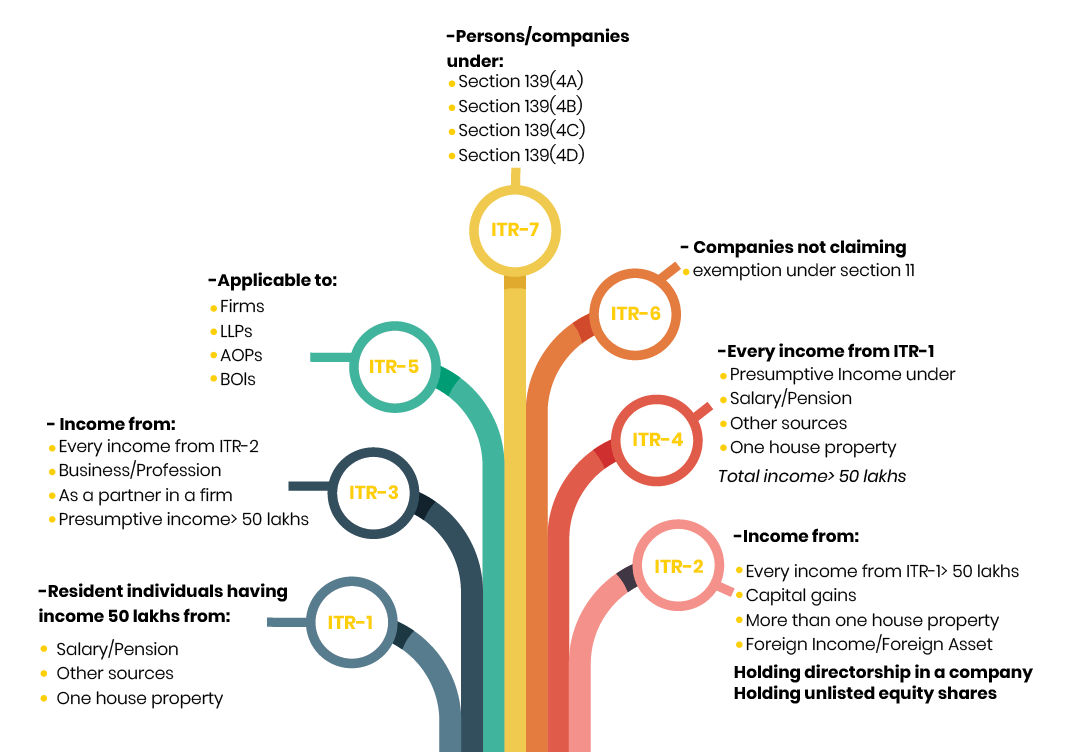

The Central Board of Direct Taxes (CBDT) has released a notification regarding the forms required for filing Income Tax Returns (ITR). Taxpayers can download forms such as SAHAJ ITR-1, ITR-2, ITR-3, SUGAM ITR-4, ITR-5, and ITR-6 for their filing needs.

India’s Income Tax Laws are established by the Government to impose taxes on the taxable income of various entities, including individuals, Hindu Undivided Families (HUFs), companies, firms, LLPs, associations of persons, bodies of individuals, local authorities, and other artificial juridical persons. The tax liability of a person is determined based on their residential status. Individuals who qualify as residents of India are required to pay taxes on their global income. Taxpayers must adhere to specific rules and guidelines each financial year while filing their Income Tax Returns (ITRs).

Who Are Bound to File Income Return in India?

Under the Income Tax Act, income tax is applicable only to individuals or businesses that fall within specified income brackets. Below are some entities or businesses that are mandatorily required to file their Income Tax Returns (ITRs) in India:

1. All individuals below the age of 60 whose total income for a financial year exceeds ₹2.5 lakh are required to file their ITR. For senior citizens aged 60-79, the limit is ₹3 lakh, and for super senior citizens aged 80 and above, the limit is ₹5 lakh. It is important to note that the total income must be calculated before applying deductions under Sections 80C to 80U and exemptions under Section 10 .

2. All registered companies, regardless of whether they have generated a profit or not during the year, are required to file their Income Tax Returns.

3. Individuals or entities seeking a refund for excess tax deducted or overpaid income tax are required to file their Income Tax Returns.

4. Individuals who own assets or have financial interests in entities located outside India are required to file their Income Tax Returns.

5. Foreign companies that claim treaty benefits on transactions conducted in India are required to file their Income Tax Returns.

6. NRIs who earn or accrue more than Rs. 2.5 lakh in India in a single financial year.

Documents Required to File Income Tax Return

It is essential to have all the relevant documents ready before starting the e-filing process to ensure a smooth and accurate submission of your Income Tax Return.

Post Office and Bank savings account passbook, as well as PPF account passbook, are important documents to have on hand for the e-filing process, as they contain details of interest earned and other relevant information.

Salary slips

Aadhar Card, PAN Card.

Form 16 is a TDS certificate issued by your employer is an important document for e-filing. It provides details of the salary paid to you and any TDS (Tax Deducted at Source) deducted on your salary, which is required for accurate income tax filing.

Interest certificates from banks and post offices are important documents for e-filing your Income Tax Return. These certificates provide details of the interest income earned during the financial year, which must be reported in the return.

Form 16A is a TDS certificate issued when tax is deducted on payments other than salaries, such as interest received from fixed deposits, recurring deposits, etc., above the specified limits as per current tax laws. This form is necessary for e-filing your Income Tax Return if TDS has been deducted on such payments.

Form 16B is a TDS certificate provided by the buyer if you have sold a property. It shows the TDS deducted on the amount paid to you from the sale. This form is required for e-filing your Income Tax Return if TDS has been deducted on the property transaction.

Form 16C is a TDS certificate issued by your tenant, providing details of the TDS deducted on the rent paid to you, if applicable. This form is necessary for e-filing your Income Tax Return if TDS has been deducted on the rental income.

Form 26AS is your consolidated annual tax statement, which provides a summary of all taxes deposited against your PAN. It includes details of Tax Deducted at Source (TDS), Tax Collected at Source (TCS), advance tax payments, and other tax-related transactions. This form is essential for verifying the tax credits while filing your Income Tax Return.

TDS deducted by your employer

TDS deducted by banks

TDS deducted by any other organizations from payments made to you

Advance taxes deposited by you

Self-assessment taxes paid by you

Tax saving investment proofs

Proofs to claim deductions under section 80D to 80U (health insurance premium for self and family, interest on education loan)

Home loan statement from bank

Types of Income Tax Return

The official website of the Income Tax Department provides several forms that taxpayers may need to fill out based on their income. While some of these forms are simple to complete, others may require additional disclosures, such as profit and loss statements. To help you navigate the process, here’s a quick guide to the available forms:

| ITR Form | Applicable to | Salary | House Property | Business Income | Capital Gains | Other Sources | Exempt Income | Lottery Income | Foreign Assets/Foreign Income | Carry Forward Loss |

|---|---|---|---|---|---|---|---|---|---|---|

| ITR-1 / Sahaj | Individual, HUF (Residents) | Yes | Yes (One House Property) | No | No | Yes | Yes (Agricultural Income less than Rs 5,000) | No | No | No |

| ITR-2 | Individual, HUF | Yes | Yes | No | No | Yes | Yes | Yes | Yes | Yes |

| ITR-3 | Individual, HUF, partner in firm | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| ITR-4 | Individual, HUF, firm | Yes | Yes (One House Property) | Presumptive Business Income | No | Yes | Yes (Agricultural Income less than Rs 5,000) | No | No | No |

| ITR-5 | Partnership firm / LLP | No | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| ITR-6 | Company | No | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| ITR-7 | Trust | No | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

How to Login or Register on the E-filing Portal

Step 1 :Visit the e-Filing portal at https://www.incometax.gov.in/iec/foporta

Step 2 :Register or log in to e-file your income tax returns.

In case you have registered yourself on the portal earlier, click on the ‘Login’ Here’ button.

In case you have not registered yourself on the portal, click on the ‘Register’ Yourself’ button.

Step 3:Click on ‘Taxpayer,’ enter your PAN details, and click ‘Validate.’ Then, select ‘Continue.’

Step 4 :Enter details like your name, address, gender, residential status, date of birth, and other required information.

Step 5 :Provide your Email ID and registered mobile number.

Step 6 :Once the form has been filled up, click on ‘Continue’.

Step 7 :Verify your details, after which a 6-digit One-Time Password (OTP) will be sent to your registered mobile number and email address.

Step 8 : Enter the OTP and follow the instructions provided to complete the registration process successfully.

Step 9 :After the OTP is verified, a new window will appear where you can review the details you provided. If any information is incorrect, update it, and a new OTP will be sent to validate the changes.

Step 10 :The final step will be set up a password and secure login message.

Step 11 :Click on ‘Register,’ and you will receive an acknowledgment message confirming that the registration process has been successfully completed.

A Step by Step Guide on How to E-file Income Tax Returns on the Portal

Calculate your income tax liability based on the provisions of the income tax laws. Use your Form 26AS to summarize your TDS payments for all four quarters of the assessment year. Based on the definitions provided by the Income Tax Department (ITD) for each ITR form, determine the category you fall under and select the appropriate ITR form.

Follow the steps outlined below to e-file your income tax returns using the Income Tax e-filing portal:

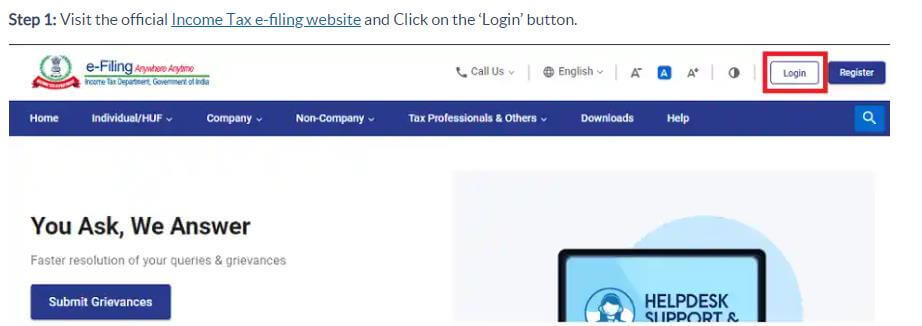

Step 1: Go to the official Income Tax e-filing website and click on the ‘Login’ button.

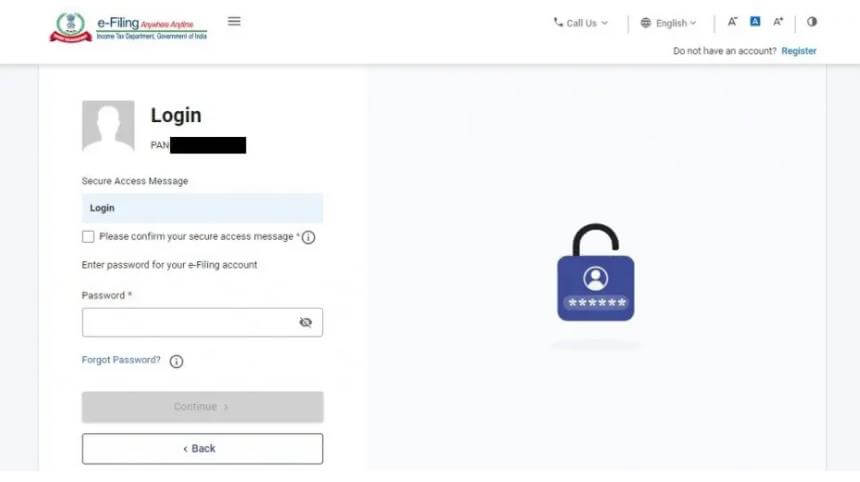

Step 2: Next, Enter Username then Click continue and After enter your Password.

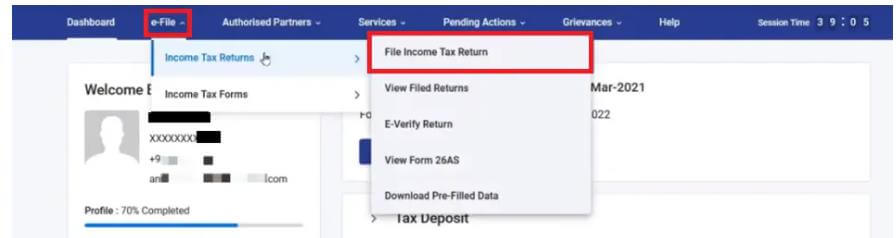

Step 3: After logging into the portal, click on the ‘e-file’ tab and then select ‘File Income Tax Return’.

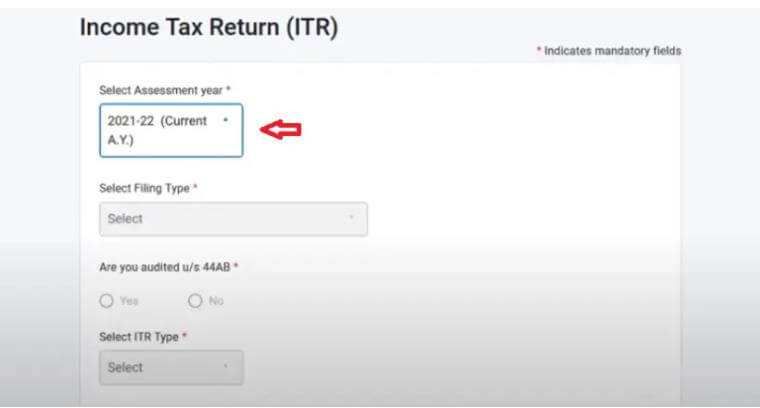

Step 4: Select the Assessment year for which you wish to file your income tax returns and click on ‘Continue’.

Step 5: You will be prompted to choose between filing your returns online or offline. Select the online option, as it is the recommended mode of tax filing.

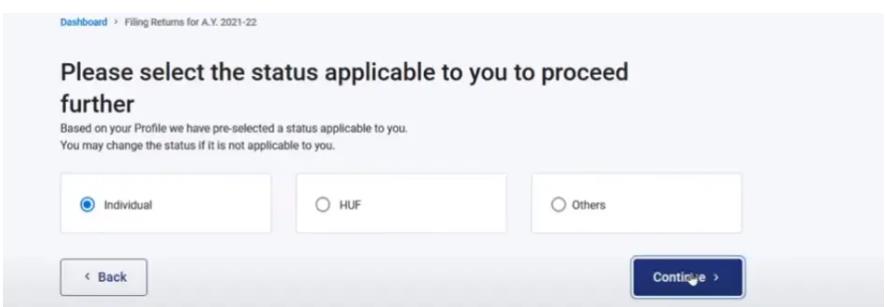

Step 6: Select whether you wish to file your income tax returns as an individual, Hindu Undivided Family (HUF), or others. Choose the ‘individual’ option.

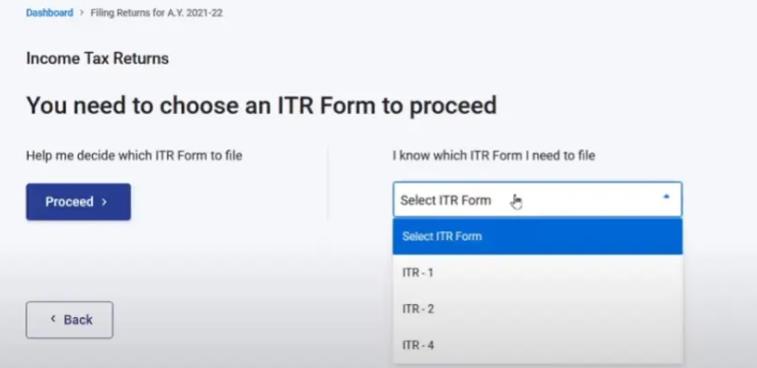

Step 7: Select the income tax return (ITR) form you wish to file. For instance, ITR 2 can be filed by individuals and HUFs who don’t have income from business or profession. If you’re an individual, you can choose either ITR1 or ITR4. In this case, click on ‘Proceed with ITR1’.

Step 8: The next step will ask you to specify the reason for filing your returns, either above the basic exempted limit or due to the seventh provision under Section 139(1). According to this provision, an individual must file their income tax returns if the aggregate amount deposited in one or more current accounts exceeds Rs. 1 crore during the year, if the total expenditure on foreign trips exceeds Rs. 2 lakh, or if a payment of more than Rs. 1 lakh is made on electricity bills. Ensure you choose the correct option.

Step 9: Enter the details of your bank account. If you have already provided your bank account details, simply pre-validate them.

Step 10: You will be directed to a new page to file your income tax returns. The page will pre-fill many details. Review the information carefully to ensure all details are correct. Confirm the summary of your returns and validate them.

Step 11: The final step is to verify your returns. After verification, you will need to send a hard copy to the Income Tax Department. The verification process is mandatory.

Guide on How to File ITR Offline for Super Senior Citizens

Super senior citizens (individuals aged 80 years and above) are given the option to file their ITR offline during the financial year. Additionally, an individual or HUF with an income of less than Rs. 5 lakh and not entitled to receive a refund can also file their ITR offline.

The step-by-step procedure to file returns offline is mentioned below:

1. Individuals must request for a Form 16.

2. Next, you will need to submit the ITR returns in the paper form at the Income Tax Department.

3. Once the form has been submitted, you will receive an acknowledgement slip from the Income Tax Department.

Benefits of Filing Income Tax Return

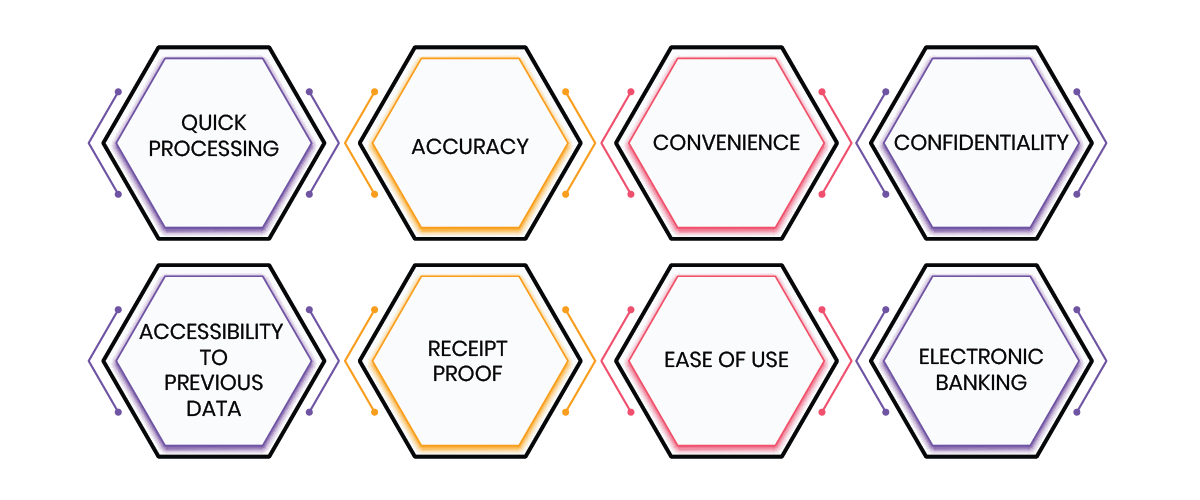

1.QUICK PROCESSING: The acknowledgment of Income Tax Return (ITR) is processed quickly. Refunds, if applicable, are processed faster compared to paper-filed returns.

2. ACCURACY: E-filing software includes built-in validations and seamless electronic connectivity, which significantly reduces errors. Paper filing can lead to mistakes, and when paper-based forms are migrated to the electronic system, human error in data entry may occur.

3.CONVENIENCE: There are no time or location restrictions for online filing. E-filing is available 24/7, allowing you to file your returns anytime and from anywhere, at your convenience.

4.CONFIDENTIALITY: E-filing offers better security than paper filings, as your data is protected from unauthorized access. With paper filing, sensitive income details can be exposed at your chartered accountant’s office or within the income tax department.

5.ACCESSIBILITY TO PREVIOUS DATA: You can easily access past data while filing returns. Most e-filing applications store data securely and allow easy access when filing future returns.

6.RECEIPT PROOF: You receive immediate confirmation of filing, both during the filing process and subsequently via email to your registered email address.

7.EASE OF USE: E-filing is user-friendly, with detailed instructions that make it easy for individuals, even those not very familiar with the internet, to file their returns.

8.ELECTRONIC BANKING: E-filing offers the convenience of direct deposit for refunds and direct debit for tax payments. You can file now and pay later, with the option to choose the date for your bank account to be debited for tax payments, along with other convenient features.

Why Choose Legaltax?

1.We offer comprehensive legal assistance with a strategic approach, ensuring a quick and efficient process.

2.Our experts guide you through every step, making it easy to understand.

3.We go the extra mile to help businesses achieve their goals.

4.Our commitment is to provide the best services to our customers and resolve any issues related to the ITR process promptly.

FAQ’s

Overview of Income Tax Return (ITR):

An Income Tax Return (ITR) is a form filed by individuals, businesses, or other entities to report their income, expenses, and other financial details to the tax authorities. The main purpose of filing an ITR is to calculate the amount of tax liability and ensure compliance with tax laws.

Key points about Income Tax Return:

- Mandatory Filing: Individuals whose income exceeds the basic exemption limit are required to file an ITR. It is also mandatory for businesses and professionals.

- Income Reporting: The return provides a platform to declare all income sources such as salary, business income, rental income, capital gains, etc.

- Tax Calculation: Based on the declared income, eligible deductions (like Section 80C for savings, investments, etc.), and any advance tax paid, the tax liability is calculated.

- Refund Processing: If excess tax has been paid or TDS (Tax Deducted at Source) exceeds the tax liability, the taxpayer can claim a refund.

- ITR Forms: The Income Tax Department provides different ITR forms based on the nature of income and the taxpayer’s category (individual, HUF, company, etc.).

- E-Filing: The process of filing ITR is now mostly online (e-filing), making it easier, faster, and more accurate. It can be done through the Income Tax Department’s official e-filing portal.

- Deadline: There are specific deadlines for filing ITR for different taxpayers, and delays can attract penalties.

Income tax is applicable to individuals, businesses, and other entities based on their income levels and other factors. Here are the primary categories of taxpayers who are required to pay income tax:

- Individuals:

- Income Threshold: Individuals earning income above the basic exemption limit set by the government need to pay income tax. The exemption limit varies based on age, such as:

- Below 60 years: Income above ₹2.5 lakh is taxable.

- Between 60-80 years (Senior Citizens): Income above ₹3 lakh is taxable.

- Above 80 years (Super Senior Citizens): Income above ₹5 lakh is taxable.

- Types of Income: Salary, business income, rental income, capital gains, and interest are taxable.

- Income Threshold: Individuals earning income above the basic exemption limit set by the government need to pay income tax. The exemption limit varies based on age, such as:

- Hindu Undivided Families (HUF):

- Taxable on Income: HUFs are taxed on their total income, similar to individuals. The income could include earnings from business, investments, or other sources.

- Businesses and Companies:

- Corporate Tax: Companies, including private and public limited companies, are subject to corporate tax based on their income. The tax rates for companies are generally higher compared to individuals and vary based on their turnover.

- Partnership Firms & LLPs: These are taxed on the income generated, and tax is levied on the firm or LLP itself rather than on the individual partners.

- Non-Residents:

- Income Earned in India: Non-resident individuals and foreign entities are required to pay income tax on income earned or received in India.

- Freelancers and Professionals:

- Individuals working as freelancers or professionals (e.g., doctors, consultants, or writers) must pay tax on the income generated from their services, subject to applicable exemptions or deductions.

- Trusts and Charities:

- Taxable Income: Trusts and charitable organizations are required to pay tax on any income that is not used for charitable purposes. Some exemptions and deductions are available under the Income Tax Act.

The ITR-3 form is meant for individuals, Hindu Undivided Families (HUFs), and firms (other than LLP) who have income from a business or profession. However, there are certain categories of individuals who should not file ITR-3. These include:

- Individuals and HUFs without business or professional income:

- If you do not have any income from a business or profession, you should not file ITR-3. For example, if your income is only from salary, pension, or other sources, you should use ITR-1 or ITR-2, depending on your circumstances.

- Income from Salaries and Pension:

- If you earn only salary income, pension, or income from other sources like interest or dividends, you should not file ITR-3. Instead, ITR-1 (Sahaj) or ITR-2 is more appropriate.

- Income from Capital Gains (without business activity):

- If your income includes capital gains (from the sale of property or investments) but you are not carrying on business or profession related to such transactions, you should file ITR-2, not ITR-3.

- Income from a Partnership or LLP:

- If you are a partner in a partnership firm or an LLP (Limited Liability Partnership) and do not have any other business or professional income, you do not need to file ITR-3. Instead, you will need to file ITR-2 (if there is no other business income).

- Income from agriculture:

- If your income comes from agriculture (and is not related to any business or profession), you are not required to file ITR-3. Depending on the nature of your income, you may need to file ITR-1 or ITR-2.

- Income from Voluntary Contributions to Trusts or Charitable Institutions:

- If you receive income from voluntary contributions, but this income is not part of any business or professional activity, you should file ITR-2.

In summary, if your income doesn’t involve business or professional earnings and is from salary, pension, or other non-business sources, you should not file ITR-3. Instead, consider filing ITR-1 or ITR-2, depending on the details of your income.

If you miss the deadline for filing your income tax return (ITR), there are still several options available to rectify the situation:

- File a Belated Return:

- If you miss the original deadline for filing your ITR, you can file a belated return under Section 139(4) of the Income Tax Act.

- A belated return can be filed at any time before the end of the relevant assessment year (for example, for FY 2023-24, the last date to file a belated return will be March 31, 2025).

- However, if you file a belated return, there will be a penalty under Section 234F, which ranges from ₹1,000 to ₹5,000, depending on the timing of the filing. For delayed filings after the assessment year ends, the penalty could be as high as ₹10,000.

- Pay the Late Filing Fee:

- If the return is filed after the due date, a late filing fee under Section 234F is applicable:

- ₹1,000 if the total income is up to ₹5 lakh.

- ₹5,000 if the total income is above ₹5 lakh.

- This fee is mandatory for anyone filing their returns after the due date.

- If the return is filed after the due date, a late filing fee under Section 234F is applicable:

- Interest on Tax Due (Section 234A):

- If there is any tax due, interest under Section 234A will be charged for the period of delay in filing the return.

- The interest rate is 1% per month or part of the month on the amount of tax due.

- This means the longer the delay, the higher the interest you will need to pay.

- No Refund for Late Filing:

- If you are eligible for a refund, it will not be processed until you file your return. In the case of a belated return, the refund will only be processed after filing, and it might take longer than usual.

- Rectification of Mistakes (Section 154):

- If after filing the belated return you realize there is an error or omission in your return, you can file a rectification request under Section 154 with the Income Tax Department.

- This will allow you to correct mistakes such as incorrect figures or missing information in the originally filed return.

- Penalty for Concealment of Income:

- If the delay in filing is due to non-disclosure or concealment of income, the Income Tax Department may impose a penalty of up to 200% of the tax due.

- Avoiding Late Fees by Filing Early:

- While filing a belated return is allowed, it’s always best to file your return as early as possible to avoid penalties, interest, and other complications.

Paying income tax to the government is a straightforward process that can be done online or offline. Here are the steps to pay income tax:

1. Online Payment (e-Payment)

- Visit the Official Income Tax Department Website: Go to the official Income Tax e-filing portal (https://www.incometax.gov.in).

- Login: If you are a registered taxpayer, log in using your credentials. If not, you can continue as a guest.

- Navigate to the Payment Section:

- On the home page, click on “e-Pay Tax” or look for the “Pay Taxes” option under the Services tab.

- Choose the appropriate tax category based on the type of tax you want to pay (for example, “Self-assessment tax”, “Advance tax”, or “Tax on regular assessment”).

- Select the Assessment Year and Tax Applicable:

- Choose the assessment year for which you are paying the tax.

- Select the correct payment type (e.g., Self-assessment tax, Advance tax, or Tax on regular assessment).

- Enter Tax Details:

- Enter the required details like PAN, amount of tax to be paid, and other necessary information.

- Choose Payment Mode:

- You can pay using Net Banking or Debit/Credit Card. Choose your preferred payment mode.

- Make the Payment: Complete the payment process using your selected payment method.

- Acknowledgment and Challan: Once the payment is successful, you will receive a payment acknowledgment. The challan (receipt) will be generated and can be downloaded for your records.

2. Offline Payment

- Visit Authorized Banks:

- You can pay income tax at any designated bank branch authorized by the Income Tax Department (e.g., State Bank of India, HDFC Bank, ICICI Bank, etc.).

- Obtain the Challan Form (ITNS 280):

- Download and print the challan form ITNS 280 from the Income Tax Department’s website, or obtain a copy from the bank.

- Fill in the Required Details:

- Provide details like your PAN, assessment year, tax payment type (e.g., self-assessment tax), and the amount of tax to be paid.

- Submit the Form and Make Payment:

- Submit the completed challan form at the bank counter along with the payment.

- The bank will process the payment and provide a stamped copy of the challan as a receipt.

- Retain the Challan: Keep the stamped copy of the challan as proof of payment for future reference.

3. Payment through the NSDL Portal (For Online Payments)

- Go to the NSDL Portal: Visit the NSDL website (https://www.tin-nsdl.com).

- Choose Income Tax Payment: Under the “Tax Information Network” section, choose “Pay Taxes Online.”

- Fill the Challan Details:

- Select the appropriate Challan for payment, such as Challan ITNS 280 for income tax payments.

- Fill in the necessary details, including your PAN, assessment year, tax payment type, and amount.

- Make the Payment: Pay the tax through net banking or using debit/credit cards.

- Get the Challan Receipt: Once the payment is processed, download the receipt or challan for your records.

4. Advance Tax Payment

- Schedule Payments: If you are required to pay advance tax (in case of business income or other taxable income exceeding the basic exemption limit), make payments in quarterly installments as per the due dates.

- Due Dates for Advance Tax:

- 15th June – 15% of total tax due

- 15th September – 45% of total tax due

- 15th December – 75% of total tax due

- 15th March – 100% of total tax due

- You can make these payments through the same online payment process, selecting Advance Tax as the payment type.

5. Tax Deducted at Source (TDS) Payments

- If your employer or any other party has deducted TDS from your income, the deducted amount will be deposited on your behalf. Ensure that the TDS is reflected in your Form 26AS and matches the amount owed to the Income Tax Department.

6. Important Notes:

- Use Correct Challan: Always use the correct challan for tax payment (ITNS 280 for income tax).

- Payment Timeliness: Ensure that payments are made on time to avoid penalties and interest charges.

- Tax Payment Confirmation: After making the payment, make sure to keep a copy of the payment receipt for your records and future reference.

In conclusion, income tax can be paid either online through the Income Tax Department’s portal or offline through designated banks, depending on your preference. It’s important to make the payment before the due date to avoid interest and penalties.

Yes, you can still file your Income Tax Return (ITR) even after the due date has passed. However, if you miss the last date for filing, you will need to file a belated return. Here are the key points to know:

1. Belated Return

- Section 139(4) of the Income Tax Act allows you to file a belated return after the original due date has passed.

- A belated return can be filed at any time before the end of the relevant assessment year (i.e., before March 31 of the year following the financial year in which the income was earned).

- For example, for the financial year 2023-24, the last date to file a belated return is March 31, 2025.

2. Penalties for Filing After Due Date

- If you file your return after the due date, there are penalties and consequences:

- Late Filing Fee: Under Section 234F, a late filing fee will be levied. The amount depends on your income:

- ₹1,000 if your total income is up to ₹5 lakh.

- ₹5,000 if your total income exceeds ₹5 lakh.

- Interest on Tax Due (Section 234A): You will also have to pay interest on any outstanding tax due at the rate of 1% per month or part of the month, from the due date of filing until the actual date of filing.

- Late Filing Fee: Under Section 234F, a late filing fee will be levied. The amount depends on your income:

3. No Refund for Delayed Filing

- If you are eligible for a refund, it will not be processed until you file the return. In the case of a belated return, the refund may be delayed further.

- If the belated return is filed after the end of the assessment year (i.e., after March 31 of the following year), the refund will not be processed, and the taxpayer might lose out on any refund.

4. Rectification of Mistakes (Section 154)

- If you realize there is an error or omission in your belated return after filing, you can file a rectification request under Section 154 to correct the mistake.

5. Inability to Carry Forward Losses:

- If you file a belated return, you may not be able to carry forward certain losses (such as business losses or capital losses) to the next year, which could impact your future tax planning.

No, filing a NIL Income Tax Return (ITR) is not mandatory unless you meet certain criteria. However, there are specific situations in which filing a NIL return might be necessary or beneficial. Here’s a detailed explanation:

1. What is a NIL ITR?

- A NIL ITR is filed when your income is below the taxable limit (i.e., no income tax is payable), but you still need to file a return for reasons such as fulfilling a legal obligation or maintaining a clean tax record.

2. When is NIL ITR Mandatory?

While a NIL ITR is generally not mandatory, there are certain cases when filing an ITR—even if your income is below the taxable threshold—is required:

- If You Are a Resident and Have Assets Outside India:

- If you are a resident and have assets or financial interests outside India (e.g., foreign bank accounts, investments), you may need to file a NIL ITR, even if your income is below the taxable limit.

- If You Are a Director in a Company:

- Even if you have no income, if you are a director in a company, the Income Tax Department may require you to file an ITR. This applies even if the company itself has no taxable income.

- If You Are Claiming a Refund:

- If you are due for a refund (for example, if tax was deducted at source but no tax is owed), you must file a NIL return to claim your refund, even if your income is below the taxable limit.

- If You Have Carried Forward Losses:

- If you want to carry forward any business or capital losses to subsequent years, you must file an ITR. In cases where there’s no income, the return would be NIL.

3. Other Reasons to File a NIL ITR:

- For Record Keeping: Filing a NIL ITR helps keep your tax records up to date. This may be beneficial for future tax planning or loan applications.

- Compliance with the Income Tax Department: Filing a NIL return keeps you in compliance with tax regulations, especially if you are required to file due to other factors (e.g., being a director in a company).

4. When is NIL ITR Not Required?

- If your income is below the taxable limit and you don’t meet any of the other criteria mentioned above (such as having foreign assets or being a company director), you are not required to file an ITR. In such cases, filing a NIL return is optional.

5. Penalties for Not Filing When Required:

- If you are required to file a NIL return (based on the conditions mentioned) and fail to do so, you may face penalties, interest, or legal consequences from the Income Tax Department. It is better to file the NIL return to stay compliant.

Conclusion:

A NIL ITR is not mandatory if your income is below the taxable limit, and you don’t meet specific conditions like being a director in a company or having foreign assets. However, in some cases, filing a NIL return is required to comply with tax laws or to claim refunds, carry forward losses, or maintain proper tax records. It’s always a good idea to file your return to avoid any future issues.

If you miss the due date for filing your Income Tax Return (ITR), you may be subject to penalties and additional charges. Here are the key penalties and consequences for delayed filing:

1. Late Filing Fee under Section 234F:

- As per Section 234F of the Income Tax Act, a late filing fee is applicable if you file your ITR after the due date. The fee depends on your total income:

- ₹1,000 if your total income is ₹5 lakh or less.

- ₹5,000 if your total income is more than ₹5 lakh.

- The late filing fee is payable even if you do not owe any tax (i.e., if your total income is below the taxable limit, and you are not liable to pay tax).

2. Interest for Late Payment of Tax (Section 234A):

- If you have any outstanding tax liability that is not paid by the due date, interest will be charged under Section 234A. The interest is calculated at the rate of 1% per month or part of the month on the unpaid tax amount.

- The interest is calculated from the due date of filing until the actual date of filing the return.

3. Interest on Advance Tax (Section 234B and 234C):

- If you are required to pay advance tax (i.e., if your tax liability exceeds ₹10,000), and you fail to do so or make insufficient payments, you will be charged interest:

- Section 234B: Interest at 1% per month on the unpaid advance tax, if you do not pay at least 90% of your total tax liability through advance tax.

- Section 234C: Interest at 1% per month if the advance tax paid in any installment is less than the prescribed amount for that installment.

4. No Carrying Forward of Losses:

- If you file a belated return (after the due date) under Section 139(4), you may lose the ability to carry forward certain losses (such as business losses or capital losses) to future years.

- You cannot carry forward the loss if the return is filed after the end of the assessment year (i.e., after March 31 of the following year).

5. Refund Delays:

- If you are entitled to a refund, the process may be delayed if you file the return after the due date. Refunds may take a longer time to be processed compared to timely filed returns.

6. Additional Consequences:

- Prosecution and Legal Action: In extreme cases where the delay is significant, or there is a pattern of non-compliance, the Income Tax Department may initiate legal action or prosecution under the provisions of the Income Tax Act. This could include imprisonment for severe violations, although this is rare.

7. Last Date for Filing:

- The due date for filing your return is typically July 31 for individuals, and it may be extended by the Income Tax Department in certain cases. If you miss this date, you can still file a belated return by December 31 of the assessment year (for a delayed filing without any penalties), but it will come with penalties and interest charges as mentioned above.

8. How to Avoid Penalty:

- To avoid penalties and interest, ensure that you file your ITR before the due date. If you cannot meet the deadline, file the return as soon as possible to minimize the late fees and interest.

- You can also pay the tax due as early as possible to reduce the interest burden.

Yes, even if there is a loss in your business income, you are still required to file an Income Tax Return (ITR) under certain conditions. Here’s what you need to know:

1. Filing is Mandatory in Certain Cases:

- If you are carrying on a business (sole proprietorship, partnership, etc.) and have incurred a loss in the business, you are still required to file a return if your income exceeds the basic exemption limit (which is ₹2.5 lakh for individuals below 60 years of age).

- If your total income, after deducting the business loss, is below the exemption limit, filing a return is not mandatory, but it is still advisable to file, especially if you want to carry forward the business loss to future years.

2. Carry Forward of Business Losses:

- One of the primary reasons to file a return when you have a business loss is to carry forward the losses to future years.

- Losses incurred in a business can be carried forward for up to 8 years to offset future profits and reduce tax liability in those years.

- However, to carry forward your business loss, you must file your return on time. If you file a belated return (after the due date), you may lose the ability to carry forward the loss.

3. Loss in Business vs. Other Income:

- If you have a business loss, but your total income (from salary, interest, etc.) exceeds the taxable limit, you are still required to file a return.

- On the other hand, if your total income is below the exemption limit, and the business loss is your only source of income, you are not obligated to file the return, but you can choose to file it voluntarily to carry forward the loss.

4. ITR Forms to Use for Business Loss:

- If you are an individual, HUF, or a business entity (e.g., a partnership), you need to file the appropriate ITR form based on your income and business structure:

- ITR-3 or ITR-4 (depending on the nature of the business) should be used if you have business income (even if it’s a loss).

- You will need to fill out the details of your business income, including the loss, in the relevant sections of the return.

5. No Filing Requirement for Certain Businesses with Loss:

- In case your business income is zero (i.e., there are no profits or losses), and there are no other incomes to report, you may not be required to file a return, especially if your total income is below the taxable threshold.

- However, for those wishing to carry forward losses or make claims (like a refund), it is better to file the return.

6. Penalties for Not Filing Despite Loss:

- If you are required to file a return (for example, due to business losses or other income sources), and you fail to file it, you could be penalized under Section 234F (late filing fee), even if there is no taxable income.

- However, if you have incurred a business loss and do not file your return, you lose the opportunity to carry forward those losses for future offsetting.

Conclusion:

While you may not be required to file an Income Tax Return (ITR) if your business has incurred a loss and your total income is below the exemption limit, it is highly recommended to file a return in such cases if you want to carry forward the loss to offset future profits. Additionally, it ensures compliance with tax laws and helps you maintain accurate tax records. If your total income exceeds the taxable limit, you must file the return, even if the business income shows a loss.

Form-16 is a certificate of TDS (Tax Deducted at Source) issued by an employer to an employee. It summarizes the total salary paid to the employee and the amount of tax that has been deducted by the employer and deposited with the Income Tax Department. Form-16 is an important document for individuals filing their Income Tax Returns (ITR) as it serves as proof of the tax that has already been paid on their behalf.

Key Components of Form-16:

Form-16 is divided into two parts:

Part A:

- Employer’s Details: Contains information about the employer (such as the name, PAN, address, and TAN).

- Employee’s Details: Contains information about the employee (such as name, PAN, address, and employee number).

- TDS Deducted: Provides details about the total salary paid and the tax deducted at source (TDS) for the financial year.

- Period of Employment: This section includes the period during which the TDS was deducted (usually from April 1st to March 31st).

- Challan Details: Lists the details of the tax deposited with the Income Tax Department.

Part B:

- Breakdown of Salary: Provides a detailed breakdown of the salary, including basic salary, allowances, perquisites, and other components.

- Deductions: Includes details of deductions like those under Section 80C (for investments in PPF, life insurance, etc.) and other eligible deductions under the Income Tax Act.

- Taxable Income: Shows the taxable income after considering exemptions and deductions.

- TDS Computation: This shows the tax that has been deducted from the salary and deposited with the tax authorities.

- Total Taxable Income and Tax Payable: Summarizes the taxable income, total tax payable, and the amount of tax already deducted and paid.

If you fail to file your Income Tax Return (ITR) on time, there are penalties and charges associated with the delay. The charges for default filing depend on various factors, including the timing of your filing and the amount of tax liability. Here’s a breakdown of the charges and penalties for late or default filing:

1. Late Filing Fee under Section 234F:

Under Section 234F of the Income Tax Act, a late filing fee is charged if you miss the due date for filing your ITR. The fee depends on your total income and the timing of the filing:

- If your total income is ₹5 lakh or less:

- Late filing fee is ₹1,000.

- If your total income is more than ₹5 lakh:

- Late filing fee is ₹5,000.

These fees apply if you file your return after the due date but before December 31st of the assessment year (for the financial year concerned).

2. Interest under Section 234A (for Late Payment of Tax):

If you have any outstanding tax liability and fail to pay it by the due date, you will be charged interest under Section 234A. The interest is calculated at the rate of 1% per month (or part of the month) on the unpaid tax amount. The interest is calculated from the due date of filing the return until the date the return is filed.

3. Interest for Underpayment of Advance Tax under Section 234B and 234C:

- Section 234B: If you fail to pay advance tax (i.e., tax paid in installments during the year) or if you underpay it, you will be charged interest at 1% per month on the unpaid amount.

- Section 234C: If you don’t pay the required advance tax for any installment, you will be charged interest at 1% per month for the shortfall.

4. Loss of Carrying Forward of Losses:

- If you file a belated return (after the due date), you may lose the opportunity to carry forward certain losses (such as business losses, capital losses) to subsequent years. This can result in higher tax liabilities in the future.

5. Penalty for Concealment of Income (Section 270A):

If the Income Tax Department finds that you have concealed income or provided inaccurate information in your tax return, they can impose a penalty under Section 270A:

- The penalty for concealment can be between 50% to 200% of the tax payable on the concealed income.

6. Prosecution for Serious Default:

In cases of significant and deliberate default, the Income Tax Department may initiate criminal prosecution. This could lead to imprisonment of up to 7 years for severe violations such as tax evasion or fraud.

7. No Refunds for Late Filing:

If you are entitled to a refund, it will be delayed if you file a late return. The refund process may take longer as compared to timely filed returns.

8. Applicability of Late Filing Fee:

- Belated Return: If you file your return after the due date but before December 31st of the assessment year, a late filing fee of ₹1,000 or ₹5,000 will be charged.

- Revised Return: If you file a return after the due date as a revised return, you may still be liable to pay the late filing fee depending on the timing of the filing.

Conclusion:

The charges for default filing of ITR include:

- Late filing fee (₹1,000 for income ≤ ₹5 lakh, ₹5,000 for income > ₹5 lakh).

- Interest on unpaid taxes (1% per month).

- Loss of carrying forward losses.

- Penalties for concealment of income (50%-200%).

- Delays in refunds.

To avoid these charges and penalties, it is essential to file your return on time. If you miss the deadline, it’s still better to file a belated return as soon as possible to minimize penalties.

The term “Implication Form” is not a commonly recognized term in the context of income tax or taxation. However, it could be used informally or in specific contexts to refer to forms or documents that are involved in certain tax implications or legal processes. Below are a few interpretations based on the context:

1. Forms That Indicate Tax Implications:

- In some cases, “implication form” could refer to forms that are associated with specific tax implications or consequences. For example:

- Form 26AS: This form shows the TDS (Tax Deducted at Source) or advance tax payments made against your PAN, and it helps assess whether the taxes paid match the tax liabilities.

- Form 15G/15H: These forms are used to ensure that tax is not deducted on certain incomes, where the tax payable is below the taxable limit. Filing such forms has implications on tax deduction.

2. Forms with Legal or Financial Implications:

- An “implication form” could refer to any legal document or form that has significant legal, financial, or tax consequences. For example:

- Form 15CA/15CB: Used for remittance of foreign payments. These forms have implications for foreign transactions and are required to be filed before sending money outside India.

- Income Tax Return (ITR) Forms: The form you file, such as ITR-1, ITR-2, ITR-3, etc., can have various implications for your tax assessment, refund, or liabilities.

3. Tax Implications or Penalty Forms:

- In the case of missed tax filings or penalties, the term “implication form” might be informally used to refer to any form or document that outlines the consequences or implications of non-compliance with tax laws, such as penalties for not filing on time, late filing fees, or notices from the Income Tax Department.

4. Forms Involved in Tax Disputes:

- Sometimes, the term might be used to refer to forms involved in tax disputes or appeals, such as a Notice of Demand (Form 8) or Appeal Forms that are used when a taxpayer disputes an assessment or tax implication.

Conclusion:

While “implication form” is not a standard term in tax laws, it could refer to any form or document that has significant tax implications or consequences. This might include forms related to tax assessment, penalties, tax refunds, or other legal processes. If you meant a specific form in a particular context, please clarify for a more accurate response.

Income Tax Return (ITR) filing is the process through which an individual, business, or entity reports their income, expenses, and taxes paid to the Income Tax Department of India. It is a legal requirement for taxpayers to file their returns to ensure that the tax they owe to the government is paid in full, and to claim any refunds that they may be entitled to.

Filing an ITR involves submitting a form that provides a detailed account of all the income you have earned during the financial year, any deductions you are eligible for, and the taxes that have been paid or deducted on your behalf (such as TDS). The Income Tax Department uses this information to assess your tax liability and process any refunds if applicable.

Key Components of ITR Filing:

- Income Reporting:

- The ITR form requires you to report various sources of income, such as:

- Salary income

- Business or professional income

- Rental income

- Interest income

- Capital gains

- Income from other sources

- The ITR form requires you to report various sources of income, such as:

- Deductions:

- You may claim deductions for certain expenses or investments under sections like 80C, 80D, 80G, etc. This reduces your taxable income and, consequently, the tax you owe.

- Tax Calculation:

- The ITR form also requires you to calculate your total tax liability based on your taxable income after deductions. If tax has been deducted at source (TDS) by your employer or other entities, you need to include those details to ensure that the tax paid is correctly accounted for.

- Tax Paid/Refund:

- If you have already paid taxes (via TDS, advance tax, or self-assessment tax), you need to report this in the ITR. If the tax paid exceeds your actual liability, you may be entitled to a refund.

- Verification:

- After filling in the necessary details in the ITR form, you must verify your return to confirm that all the information provided is correct. Verification can be done electronically (using Aadhaar OTP, net banking, or digital signature) or manually (by sending a signed physical copy of the ITR-V form to the Income Tax Department).

Why is ITR Filing Important?

- Legal Requirement:

- Filing ITR is a legal requirement for individuals and businesses who earn a certain amount of income. If you fail to file your return, you may face penalties, fines, or legal consequences.

- Tax Liability or Refund:

- By filing ITR, you calculate your correct tax liability. If you’ve paid more tax than required, you can claim a refund. If you’ve paid less, you must pay the balance.

- Carry Forward of Losses:

- If you incur business losses or capital losses, you can carry these forward to offset future taxable income, but only if you file your ITR on time.

- Financial Proof:

- ITR serves as proof of income when applying for loans, visas, or other financial services. It helps in showing your financial credibility.

- Avoid Penalties and Interest:

- Filing your ITR on time ensures that you avoid late filing penalties and interest charges for not paying taxes on time.

- Track Record of Compliance:

- Regular filing of returns builds a track record of tax compliance, which can be beneficial for future financial transactions and engagements.

Filing an Income Tax Return (ITR) is mandatory for certain individuals, businesses, and entities based on their income and other criteria. Here is a breakdown of who should file an ITR:

1. Individuals with Income Above the Basic Exemption Limit:

- Individuals below 60 years: If your total income exceeds the basic exemption limit of ₹2.5 lakh, you are required to file an ITR.

- Senior citizens (60 years or above): If your total income exceeds ₹3 lakh, you must file an ITR.

- Super senior citizens (80 years or above): If your total income exceeds ₹5 lakh, you are required to file an ITR.

2. Individuals with Multiple Sources of Income:

- If you have income from more than one source, such as salary, business, rental income, or capital gains, you must file an ITR. Even if your total income is below the taxable limit, the government may require you to file for record-keeping and transparency.

3. Individuals Claiming Refund of Taxes Paid:

- If you have paid excess tax through TDS (Tax Deducted at Source), advance tax, or self-assessment tax, and are eligible for a refund, you need to file an ITR to claim the refund.

4. Individuals Who Have Capital Gains Income:

- If you earn income from the sale of assets (such as shares, mutual funds, property), you need to file an ITR. Capital gains are taxable, and filing an ITR ensures that the tax liability is correctly assessed.

5. Individuals Who Have Foreign Income or Assets:

- If you have any income from abroad, or if you are a resident with foreign assets or bank accounts, you are required to file an ITR to disclose these details.

6. Individuals with a Net Taxable Income from Business or Profession:

- If you are self-employed or have income from a business or profession, even if you do not meet the basic exemption limit, you should file an ITR. This is applicable if your business income exceeds ₹2.5 lakh or if you wish to carry forward any business losses to set off against future income.

7. Individuals Having a Loss to Carry Forward:

- If you have sustained a business loss, capital loss, or speculative loss, you need to file an ITR to carry forward these losses for set off against future income.

8. Individuals Who Have Paid Taxes on Their Behalf:

- If your employer or other entity has deducted taxes (TDS) on your behalf, but the total income exceeds the exemption limit or the taxes deducted are less than the taxes owed, you should file an ITR to clear any dues.

9. People with Income from a Trust, Estate, or Partnership:

- Any person receiving income from a trust, estate, or as a partner in a partnership firm is required to file an ITR, as they may have to report their share of income.

10. Companies and Businesses:

- All companies, partnerships, and limited liability partnerships (LLPs) are required to file ITR regardless of their income, profits, or losses. This includes private and public sector entities, foreign companies, etc.

Filing your Income Tax Return (ITR) offers numerous advantages, both in terms of legal compliance and financial management. Here are the key benefits of filing an ITR:

1. Legal Compliance:

- Avoid Penalties and Fines: Filing your ITR on time ensures compliance with tax laws, helping you avoid penalties and interest for late filing or non-filing.

- Meeting Legal Requirements: Filing ITR is mandatory for individuals and businesses earning above the exemption limit, or who have other specific criteria. Timely filing ensures you meet your legal obligations and stay on the right side of the law.

2. Refund of Excess Tax Paid:

- Claiming Tax Refunds: If the tax deducted at source (TDS) or advance tax paid exceeds your actual tax liability, you are eligible for a refund. Filing ITR is the only way to claim this refund.

- Avoid Overpayment: By filing ITR and accurately reporting your income and taxes paid, you can avoid overpayment of taxes in the future.

3. Carry Forward of Losses:

- Set Off Losses Against Future Income: If you have incurred business losses, capital losses, or speculative losses, you can carry them forward to offset against future taxable income, reducing future tax liabilities.

- Compensation for Losses: This allows taxpayers to adjust their income in the coming years, especially useful for individuals with fluctuating incomes.

4. Financial Record for Loans or Visa Applications:

- Proof of Income: Filing ITR provides a financial record that lenders and financial institutions require when applying for loans, mortgages, or credit cards. It helps establish your creditworthiness.

- Visa Applications: Many countries require proof of income, and ITR serves as a reliable document to show your financial stability and ability to meet visa requirements.

5. Improved Financial Transparency and Credibility:

- Building Financial History: Consistently filing ITR helps build a history of tax compliance, which enhances your financial credibility and trustworthiness.

- Audit Protection: If your returns are filed correctly and on time, they are less likely to be scrutinized by the tax authorities.

6. Faster Processing of Refunds:

- Quick Refunds: E-filing allows for faster processing of your tax refund as compared to paper-based returns. You can receive your refund directly in your bank account without delay.

- Convenience: The entire process of claiming a refund is streamlined, making it quicker and more efficient.

7. Better Tax Planning and Management:

- Efficient Tax Planning: Filing your ITR gives you an opportunity to review your income, expenses, and deductions. It helps you in planning better and optimizing your tax liabilities for the future.

- Claiming Deductions and Exemptions: Filing ITR enables you to claim eligible deductions under sections like 80C, 80D, 80G, etc., which reduce your taxable income and tax liability.

8. Convenience and Time-Saving:

- E-filing is Convenient: E-filing allows you to file returns online at any time of the day, from anywhere, without the need for paper forms or physical visits to the tax office.

- Simplified Process: The process of e-filing is user-friendly, with step-by-step guidance, which saves time and effort.

Filing your taxes brings several advantages, both personally and professionally. Here’s a list of the key benefits:

1. Legal Compliance:

- Avoid Legal Consequences: Filing taxes on time ensures you comply with the law, avoiding potential penalties, fines, or legal action for non-filing or underreporting income.

- Avoid Tax Evasion Allegations: Filing a return is a safeguard against accusations of tax evasion, and it ensures that you stay on the right side of the law.

2. Claim Tax Refunds:

- Get a Refund for Excess Taxes Paid: If taxes were deducted at source (TDS) or if you made advance payments that exceeded your actual tax liability, you can claim a refund through tax filing.

- Simplified Refund Process: Filing your return ensures that the process of claiming your refund is quicker, especially if you e-file, which is faster than manual submissions.

3. Carry Forward of Losses:

- Set Off Losses Against Future Income: By filing your tax return, you can carry forward losses (e.g., business losses, capital losses) to offset against future taxable income, reducing your future tax liabilities.

- Preserve Losses for Future Years: This provision ensures you can save on taxes in the future if your income fluctuates.

4. Eligibility for Loans and Credit:

- Financial Record for Loan Applications: Lenders, including banks and financial institutions, require proof of income to process loans. Filing your taxes provides a documented history of your financial health and income, improving your chances of securing loans.

- Access to Credit: A proper tax filing record is essential when applying for mortgages, car loans, or personal loans.

5. Improved Financial Planning:

- Better Financial Management: Filing taxes helps you keep track of your income, expenses, and deductions, encouraging better financial discipline and planning for future savings and investments.

- Optimize Deductions and Exemptions: Filing taxes allows you to take advantage of eligible tax deductions under sections like 80C, 80D, and 80G, helping you reduce your taxable income and save on taxes.

The process of filing an income tax return (ITR) in India is a step-by-step procedure that involves various stages, from gathering the necessary documents to submitting the return online. Here’s a detailed breakdown of the process:

1. Gather Required Documents:

Before you begin filing your ITR, you need to collect all the necessary documents to support your income and deductions. Common documents include:

- Form 16: A certificate issued by your employer that summarizes your salary and TDS (Tax Deducted at Source) details.

- Form 26AS: A tax credit statement that shows details of tax deducted on your behalf by your employer or other sources.

- Bank Statements: To report interest income and any other transactions.

- Investment Documents: For claiming deductions under sections like 80C, 80D, etc.

- Capital Gains Documents: If you’ve sold any assets such as property, stocks, or mutual funds.

- Other Income Details: Such as rental income, income from business or profession, etc.

2. Choose the Right ITR Form:

The first step is to determine which ITR form applies to your type of income. There are several ITR forms, including:

- ITR 1: For individuals with income from salary, pension, or other sources (excluding business income).

- ITR 2: For individuals and HUFs with income from salary, pension, capital gains, or foreign income.

- ITR 3: For individuals and HUFs who have income from business or profession.

- ITR 4: For individuals and HUFs with presumptive business income under sections 44AD, 44AE, or 44AF.

- Choose the form based on your income sources and eligibility.

3. Register on the Income Tax e-Filing Portal:

- If you haven’t registered already, go to the Income Tax e-filing website and create an account by providing your PAN, email ID, and other details.

- If you are already registered, log in to the portal using your credentials.

4. Provide Personal and Income Details:

- After logging in, select “e-File” and click on “File Income Tax Return.”

- Enter the relevant assessment year (the year for which you are filing taxes) and your income details, including salary, business income, capital gains, etc.

- You will need to provide your personal details such as name, date of birth, and PAN, as well as your income sources and deductions.

When filing your Income Tax Return (ITR), it’s essential to have all the necessary documents in place to ensure accuracy and completeness. Below is a list of the key documents you will typically need to file your tax returns:

1. Personal Identification Documents:

- PAN (Permanent Account Number): Essential for filing your return.

- Aadhaar Card: For linking with your PAN and e-verifying your return (if applicable).

- Bank Account Details: For refund processing or tax payment, including bank account number, IFSC code, and the name of the bank.

2. Income Documents:

- Form 16: Issued by your employer, this certificate contains details of your salary, tax deductions (TDS), and other income details.

- Form 26AS: A consolidated tax statement that shows the taxes deducted at source (TDS) and tax paid by you in advance.

- Salary Slips: To verify the income and tax deducted, especially if you’re employed.

- Interest Certificates: From banks or financial institutions showing income from savings accounts, fixed deposits, or recurring deposits.

3. Documents Related to Other Income:

- Income from Business or Profession:

- Profit and Loss (P&L) statement.

- Balance sheet for the business.

- Books of accounts or relevant financial statements.

- Rental Income:

- Rent agreements.

- Receipts of rent paid.

- Details of any municipal taxes or other expenses related to the property.

- Capital Gains:

- Sale deed of the asset.

- Purchase deed or details of the acquisition of the asset.

- Details of the cost of acquisition, improvement, or sale.

4. Investment and Deduction Documents:

- Form 16A: For TDS on income other than salary (like freelance income, interest income).

- Investment Proofs for Deductions:

- Section 80C: Investment in PPF, ELSS, NSC, Life Insurance Premium, Tax-saving Fixed Deposits, etc.

- Section 80D: Health insurance premiums for self, family, and parents.

- Section 80E: Interest on education loan.

- Section 80G: Donations to charity or charitable institutions.

- Section 80TTA/80TTB: Interest on savings accounts or fixed deposits for senior citizens.

- Home Loan Details:

- Loan sanction letter.

- Certificate from the bank stating principal and interest paid during the financial year.

5. Tax Payments and TDS Certificates:

- Tax Paid Challans: Challan receipts for advance tax or self-assessment tax payments made during the year.

- TDS Certificates (Form 16/16A): If taxes were deducted from your income (salary, interest, or any other income).

- Tax Calculation Sheet: If you have filed your taxes through an accountant or online tool, this sheet will show your tax calculations.

6. Other Documents:

- Details of any Foreign Income: If you have income from foreign sources, such as salary, dividends, or capital gains.

- Foreign Assets and Liabilities: If you hold any foreign assets or have liabilities in foreign countries, you’ll need to disclose these as well.

- Proof of Other Claims: Any other claims or exemptions you are entitled to, such as income from agriculture, etc.

7. For Senior Citizens (if applicable):

- Age Proof: To claim deductions for senior citizens (above 60 years), you may need to submit proof of age (such as a birth certificate or Aadhaar card).

- Senior Citizen Medical Insurance Details: If you claim deductions under Section 80D for senior citizens.

8. For Non-Resident Indians (NRIs) (if applicable):

- Bank Details of NRE/NRO Accounts: Required for reporting income and claiming any tax deductions on interest earned.

- Form 10F: To claim treaty benefits if you are a tax resident of a country with which India has a Double Taxation Avoidance Agreement (DTAA).

9. Last Year’s Tax Returns (if applicable):

- If you have filed returns previously, having copies of your last filed returns (ITR-V, Form 16, etc.) will help in cross-checking the details for this year.

Conclusion:

Having the above documents ready before you begin filing your income tax return will make the process smoother and more accurate. Make sure to cross-check each document to ensure that the information is correct and up to date to avoid any discrepancies in the filing process.

ITR-6 is a specific income tax return form that is used by companies in India. This form is used for filing income tax returns for companies that are not claiming exemptions under Section 11 (relating to income of charitable or religious trusts).

Here’s who is eligible to file ITR-6:

Eligibility for Filing ITR-6:

- Companies (Other than Section 8 Companies):

- ITR-6 is applicable to companies other than those that are registered under Section 8 of the Companies Act, 2013 (non-profit organizations).

- These companies can file their income tax returns using ITR-6, provided they are not claiming exemptions available to charitable/religious institutions under Section 11.

- Companies with Business Income:

- ITR-6 is for companies that have income from business or profession and need to report details about their income, expenditures, and tax liabilities.

- It includes reporting information such as sales, profits, losses, deductions, and more.

- Companies Filing Returns for Previous Years:

- If a company has been registered and is continuing its business activities in the current year, it can file ITR-6 even if it has been filing taxes for previous years.

- Filing for Taxable Income:

- ITR-6 must be filed by companies that have taxable income, which could be from profits and gains of business or profession, capital gains, income from other sources, etc.

- Companies Not Claiming Exemptions Under Section 11:

- If a company is registered under Section 8 (non-profit company), or if it is claiming exemptions under Section 11 (income for charitable purposes), they are not eligible to use ITR-6. They should instead file ITR-7.

ITR-6 is applicable for:

- Private limited companies

- Public limited companies

- Foreign companies operating in India

- Subsidiaries of foreign companies

- Limited liability partnerships (LLPs) that are treated as companies for tax purposes

ITR-6 Filing Requirements:

- Financial Statements: Including balance sheet, profit & loss account, and other relevant documents.

- Tax Audit Report: If the company is required to get its accounts audited under Section 44AB of the Income Tax Act.

- Details of Income: Such as business income, other income, deductions, etc.

- Details of Payments/Tax Deducted at Source (TDS): If the company has had taxes deducted at source, this needs to be reported as well.

Conclusion:

ITR-6 is specifically designed for companies (other than those under Section 8) that are filing their tax returns based on taxable income, including income from business, profession, capital gains, etc. It is important for companies to ensure they are eligible for this form before proceeding with the filing.

ITR-6 is a specific income tax return form that is used by companies in India. This form is used for filing income tax returns for companies that are not claiming exemptions under Section 11 (relating to income of charitable or religious trusts).

Here’s who is eligible to file ITR-6:

Eligibility for Filing ITR-6:

- Companies (Other than Section 8 Companies):

- ITR-6 is applicable to companies other than those that are registered under Section 8 of the Companies Act, 2013 (non-profit organizations).

- These companies can file their income tax returns using ITR-6, provided they are not claiming exemptions available to charitable/religious institutions under Section 11.

- Companies with Business Income:

- ITR-6 is for companies that have income from business or profession and need to report details about their income, expenditures, and tax liabilities.

- It includes reporting information such as sales, profits, losses, deductions, and more.

- Companies Filing Returns for Previous Years:

- If a company has been registered and is continuing its business activities in the current year, it can file ITR-6 even if it has been filing taxes for previous years.

- Filing for Taxable Income:

- ITR-6 must be filed by companies that have taxable income, which could be from profits and gains of business or profession, capital gains, income from other sources, etc.

- Companies Not Claiming Exemptions Under Section 11:

- If a company is registered under Section 8 (non-profit company), or if it is claiming exemptions under Section 11 (income for charitable purposes), they are not eligible to use ITR-6. They should instead file ITR-7.

ITR-6 is applicable for:

- Private limited companies

- Public limited companies

- Foreign companies operating in India

- Subsidiaries of foreign companies

- Limited liability partnerships (LLPs) that are treated as companies for tax purposes