Overview

Food Business Operators need who are dealing in manufacturing, storage, distribution of food and beverages, transportation, retailing, marketing etc. needs FSSAI State License. Basically, the Business having annual turnover between 12 lakhs to 20 crores and their business operates within the territory of states are mandatorily required to have the State Food License, and if in case they want to operate their business in multiple states, then they required to have Central Food License. Point to be noted that manufacturers and marketers are required to get FSSAI state License irrespective of minimum turnover. The minimum tenure of FSSAI State License is one year and the maximum turnover of FSSAI State License is five years.

FSSAI State License

For doing any food business it is mandatory to have food license. It not only involves preparation of food but everyone who handles food at various stage before it ultimately reaches the consumers like raw materials, manufacturing, processing, packaging and their distribution as well as the agencies who have taken the authority to sell them. This license basically ensures that food business runs with appropriate quality check and license. FSSAI rules and guidelines must be followed by business who requires this food license. FSSAI is responsible for the principles, standards and controls for the welfare of the business.

Overview: FSSAI

FSSAI: Food Safety and Standards Authority of India

The Food Safety and Standards Authority of India (FSSAI) was established under the Food Safety and Standards Act, 2006 (FSS Act). It is an autonomous body under the Ministry of Health & Family Welfare, Government of India, which regulates and monitors all food-related businesses in India.

If anyone intends to start a business in the food industry, such as food processing, manufacturing, distribution, or packaging, they must register with FSSAI. Packaged food products are required to have a 14-digit food license registration number printed on the packaging. This license provides critical details about the producer’s registration, permit, and state manufacturing information.

Difference Between FSSAI Basic Registration and License

It is crucial to understand that FSSAI Basic Registration is distinct from an FSSAI License. The criteria for obtaining either a license or registration depend on the size and nature of the business. Food Business Operators (FBOs) must ensure they acquire the appropriate license or registration.

State FSSAI License

- Turnover Requirement: Businesses with an annual turnover of more than Rs. 12 lakhs and less than Rs. 20 crores must obtain a State FSSAI License.

- Applicable Entities:

- Manufacturing units with a production capacity of up to 2 MT per day.

- Dairy units handling up to 50,000 liters per day.

- Hotels rated 3-star and above.

- Businesses involved in relabeling or repacking.

- Catering businesses, regardless of turnover.

- Club canteens.

Tenure of the FSSAI License

The minimum tenure for an FSSAI license is one year, while the maximum tenure is five years. FBOs must renew their licenses on time to ensure compliance and avoid penalties.

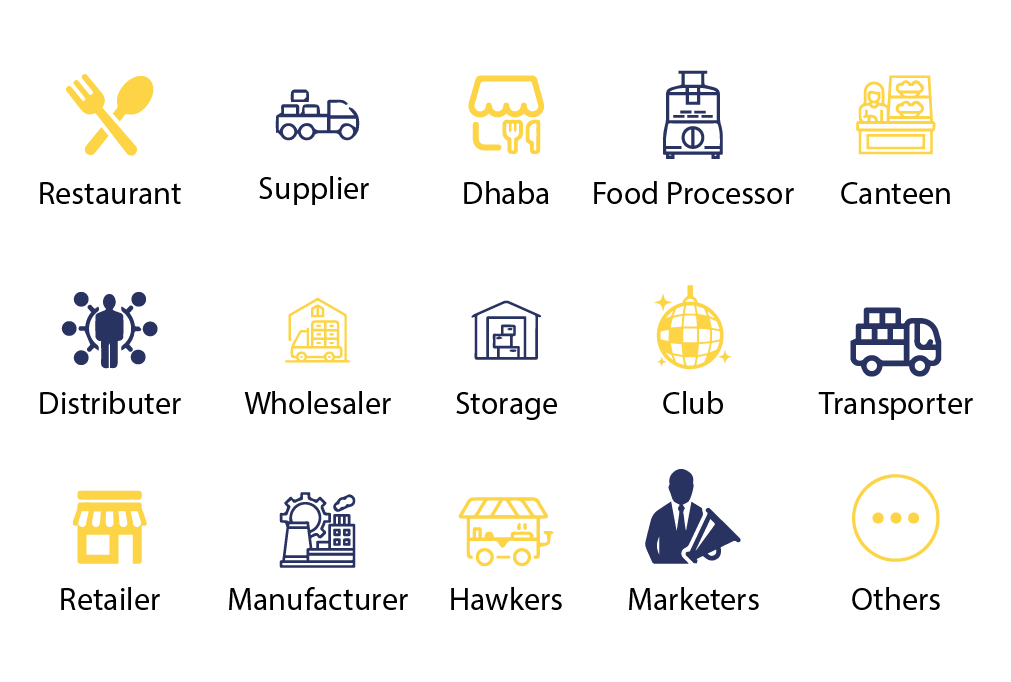

Who Needs FSSAI State License?

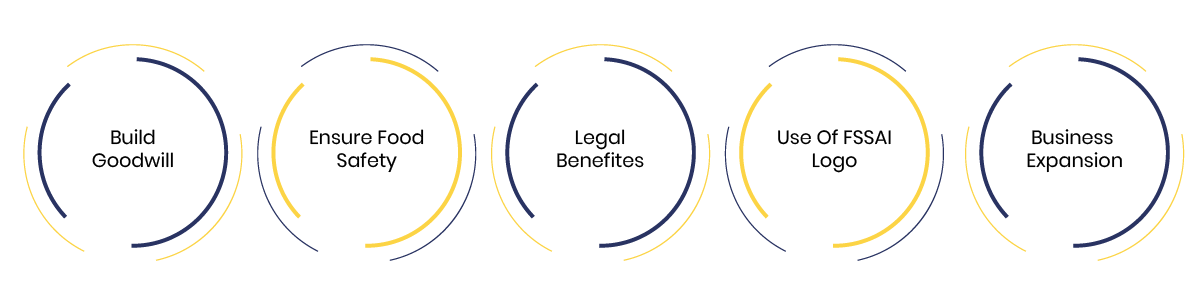

Why Fssai State License is Important?

The following reasons are mentioned below which shows the importance of FSSAI State License:

- The penalty for not having a Food License is significantly higher than the cost of obtaining one. Acquiring a Food License not only ensures compliance with food safety regulations but also acts as a preventive measure against legal penalties and proceedings. It safeguards food businesses from unnecessary fines, reputational damage, and operational disruptions.

- The Food License provides assurance that the food being manufactured adheres to the prescribed standards, as the license is granted only after a thorough verification process ensuring the quality and safety of the food.

- As per the Food Safety and Standards Act, it is mandatory for all Food Business Operators (FBOs) engaged in any food-related activities to obtain a valid Food License.

- In case a business aims to participate in corporate ventures or government tenders, possessing an FSSAI License can serve as a crucial requirement and enhance credibility.

- The FSSAI License serves as evidence that the food is pure, non-adulterated, safe, and harmless, ensuring it meets the standards required for consumer consumption.

- The FSSAI logo can be displayed by the license holder on menu cards and other promotional materials, providing a competitive edge over unregistered Food Business Operators (FBOs).

Procedure for Obtaining Fssai State License

There are three steps to obtain FSSAI State License:

- Documentation and Consultation:

Form filling

Our expert will contact you Form filling

Provide all the necessary documents for the process

2.Application Filing and approval:

After all the process of filing of the application form, our expert will get in touch with the authorities and tries to resolve all the queries.

We will follow-up with the food department and get your license approved by the government.

3.Delivery of Food License :

Approval and issuance of the food license

After the license has been approved, a digital and paper copy will be delivered to you on the address provided by you.

FSSAI State License Benefits

The advantages of obtaining food license which has been enjoyed by the Food Business Operators are as follows:

- Obtaining an FSSAI State License helps in gaining recognition for your brand at a global level and creates awareness among consumers and the public about food safety and quality.

Documents Required for FSSAI State License:

- Form B: Duly completed and signed by the proprietor or authorized signatory.

- Photograph: Passport-sized photograph of the applicant.

- Identity Proof: Aadhaar card, PAN card, voter ID, or any government-issued ID.

- Address Proof: Utility bill, rent agreement, or property tax receipt for the business premises.

- Proof of Possession: Ownership or rental documents of the business location.

- Food Safety Management System (FSMS) Plan: A detailed self-declaration or plan.

- List of Food Products: Details of the food items the business will handle or manufacture.

- No Objection Certificate (NOC): From the municipality or local body (if applicable).

- Business Registration Certificate: Such as GST registration or incorporation certificate.

- Other Documents: As required by the state authority depending on the business type and scale.

Documents Required for FSSAI State License

- Partnership deed of partnership firm

- Affidavit for proprietorship firm

- List of the categories of the food to be manufactured

- Manufacturer Authority letter

FSSAI State License Government Fee

FSSAI State License Government Fee

The FSSAI State License fee varies based on the annual turnover of the food business operator (FBO) and the type of food business. The general fee range for an FSSAI State License is:

- Small to Medium-Sized Businesses (Annual Turnover: Rs. 12 lakhs to Rs. 20 crores): Rs. 2,000 to Rs. 5,000 per year, depending on the specific type of business and its operations.

This fee is payable during the application process and can be done online or offline as per the guidelines provided by FSSAI. The license is typically valid for 1 to 5 years, depending on the payment and type of license granted.

License Renewal

Once the validity time is over, now there will be requirement for renewal of FSSAI License otherwise the registration will get expired.

Punishment/non-compliance

Everyone must comply with the concerned authority and follows the guidelines and the laws related to the FSSAI. If in case any business fails to comply with the provided rules and regulations, a set of penalties would be imposed on violators as this is the matter of concern with the health and safety of people.

Why to Choose Legaltax

The State Food License is a certification issued by the Food Safety and Standards Authority of India (FSSAI) for food businesses operating in a particular state. It is required for food businesses with an annual turnover between Rs. 12 lakhs and Rs. 20 crores or those involved in medium-scale food retailing, manufacturing, processing, packaging, and storage activities.

The license ensures that the business complies with food safety and hygiene standards set by FSSAI. It is essential for businesses to obtain a State Food License if they fall within the specified turnover range or operate in certain food sectors like hotels, dairy units, and large-scale food manufacturers.

Businesses must apply through the FSSAI website or local authorities and provide necessary documentation, including proof of identity, address, and food safety management system. The license is generally valid for 1 to 5 years and needs to be renewed before its expiry.

A State Food License is a license issued by the Food Safety and Standards Authority of India (FSSAI) for food businesses that operate within a specific state. It is required for food businesses with an annual turnover between Rs. 12 lakhs and Rs. 20 crores or those involved in medium-scale food operations such as manufacturing, processing, packaging, and storage.

The State Food License ensures that the food business adheres to the food safety standards and regulations set by FSSAI. It serves as proof that the business has been inspected and approved by the relevant authorities to operate in compliance with food safety guidelines.

Obtaining a State Food License is mandatory for businesses like hotels, dairy units, large-scale food manufacturers, and any other establishments involved in food-related activities within the specified turnover range. The license is valid for a period of 1 to 5 years and requires renewal before expiry.

Yes, the export of food products from India requires a No Objection Certificate (NOC) from the Food Safety and Standards Authority of India (FSSAI). The NOC ensures that the food products meet the necessary food safety standards and regulations set by FSSAI, which are in compliance with international food safety norms.

To obtain the NOC, the exporter must submit the following:

- A request for an NOC to FSSAI.

- A copy of the FSSAI food license.

- Necessary documents like the product details, testing reports, and a declaration confirming that the food products comply with the safety standards.

The NOC is essential for food export businesses to assure foreign customers and regulatory bodies that the food products are safe for consumption and comply with international standards.

The FSSAI license can be renewed after its expiry by following a simple process. The renewal application must be submitted at least 30 days before the expiration date to avoid penalties or legal issues. Here’s how the process works:

- Log in to the FSSAI Portal:

- Visit the official FSSAI website and log in using your credentials.

- Select License Renewal:

- Navigate to the option for license renewal and select it.

- Fill in the Renewal Form:

- Complete the renewal form by entering your business details, along with the necessary updated information.

- Upload Required Documents:

- Upload documents like the identity proof, address proof, and any other required documents, along with your original FSSAI license.

- Pay Renewal Fee:

- The renewal fee will depend on the type and size of your business. Make the payment online using available methods like debit/credit cards or net banking.

- Submit Application:

- Once the form is complete, submit the application.

- Receive Renewal Confirmation:

- After verification, the FSSAI will process the renewal request. You will receive an updated FSSAI license certificate online.

If you miss the renewal deadline, a penalty of Rs. 100 per day will be charged until the license is renewed.

Safety and Standards Authority of India (FSSAI). Here’s a list of the key documents you will need:

- Proof of Identity and Address

- Aadhaar card, PAN card, voter ID card, driving license, passport, or any government-issued identity proof.

- Business Address Proof

- Rent agreement, electricity bill, property tax receipt, or any document proving the location of the food business.

- Food Safety Management Plan (FSMS)

- A declaration outlining the measures and systems adopted by the business to ensure food safety and quality standards.

- List of Food Products

- A detailed list of food products that the business deals with, including manufacturing, processing, packaging, or selling food items.

- Layout Plan of the Business Premises

- A diagram of the layout of the premises where the business is operating, showing areas for storage, preparation, packaging, etc.

- Certificate of Incorporation/Partnership Deed

- If the business is a company or partnership, you need to submit the certificate of incorporation or partnership deed.

- List of Directors or Partners

- A list of directors or partners, along with their details such as name, address, and identification proof.

- No Objection Certificate (NOC)

- NOC from the local authority for running the food business in the premises.

- Statement of Turnover

- Proof of annual turnover, including documents such as financial statements or a turnover certificate.

- Other Documents as Required by Local Authorities

- Additional documents based on the type and size of the food business may be required.

Once you gather and upload the necessary documents, the FSSAI will process your application, and upon approval, you will receive the FSSAI State License.

Yes, it is mandatory to have an FSSAI license for any food export unit in India. All food business operators (FBOs) involved in the export of food products must comply with the Food Safety and Standards Act, 2006, and obtain an FSSAI license. This includes manufacturers, processors, packers, and exporters of food products.

The FSSAI license ensures that the food products exported are safe, hygienic, and meet international food safety standards. The export of food products is regulated under the FSSAI’s Export Division, and a specific export NOC (No Objection Certificate) from FSSAI is required for food products meant for export. This ensures the quality and safety of the products as per the global food standards.

An FSSAI license is necessary to:

- Ensure food safety for international markets.

- Comply with international trade agreements and food safety regulations.

- Demonstrate credibility to foreign buyers and regulatory authorities.

- Avoid rejection or disputes during the export process.

Therefore, obtaining an FSSAI license is a crucial step for any food exporter to ensure smooth operations and compliance with the law.

Yes, anyone involved in the sale of food items in India is required to obtain a license or registration from FSSAI. According to the Food Safety and Standards Act, 2006, all food business operators (FBOs) involved in the manufacturing, processing, packaging, storing, distributing, or selling of food products must be registered or licensed with FSSAI.

The requirement depends on the size, nature, and turnover of the business. The FSSAI issues three types of licenses:

- Basic Registration – For small businesses with an annual turnover of less than Rs. 12 lakhs.

- State License – For medium-sized businesses with a turnover of Rs. 12 lakhs to Rs. 20 crores.

- Central License – For large-scale businesses with a turnover exceeding Rs. 20 crores.

Even small-scale businesses or petty food vendors (like local food carts or small retailers) need to obtain FSSAI basic registration, ensuring food safety standards are met. This is crucial for:

- Ensuring food safety and quality.

- Building consumer trust and confidence in the food products.

- Avoiding legal penalties and business disruptions.

Thus, FSSAI registration is essential for anyone involved in the sale of food items in India.

The procedure for obtaining a State FSSAI License is as follows:

- Determine Eligibility:

- State FSSAI License is required for food businesses with an annual turnover between Rs. 12 lakhs and Rs. 20 crores or businesses involved in medium-scale food manufacturing, processing, storage, and distribution.

- Register on the FSSAI Portal:

- Choose the License Type:

- After logging in, select “State License” as the type of license you are applying for.

- Fill the Application Form:

- Complete the online application form with the required business details such as:

- Business name and address

- Type of business (e.g., manufacturing, processing, packaging, etc.)

- Category of food products

- Turnover and other financial details

- Upload Documents:

- Submit the required documents:

- Proof of identity and address (e.g., Aadhaar card, PAN card, etc.)

- Proof of business premises (e.g., rent agreement, electricity bill, etc.)

- List of food products (if applicable)

- Food safety management plan (if applicable)

- Other documents as per the state authority’s requirements

- Pay the Application Fee:

- Pay the prescribed application fee for the State FSSAI License online through debit/credit card, net banking, or other available payment methods.

- Submit the Application:

- After filling out the form and uploading the required documents, submit the application.

- Inspection (if applicable):

- FSSAI authorities may conduct an inspection of your business premises to ensure compliance with food safety and hygiene standards.

- Approval and Issuance of License:

- If everything is in order, the FSSAI will issue the State License. You can download and print the license from the FSSAI portal.

- Validity and Renewal:

- The State FSSAI License is valid for 1 to 5 years, depending on the payment made. Renew the license before its expiration to avoid penalties.

By following these steps, food businesses can secure the State FSSAI License and ensure compliance with food safety regulations.

Noncompliance refers to the failure to adhere to or follow the prescribed rules, regulations, standards, or laws. In the context of the FSSAI (Food Safety and Standards Authority of India), noncompliance means not meeting the requirements set out under the Food Safety and Standards Act, 2006, or failing to obtain the necessary food license or registration.

Examples of noncompliance in the food industry include:

- Operating without an FSSAI License: Running a food business without obtaining the required license or registration from FSSAI.

- Failure to Maintain Food Safety Standards: Not following the safety and hygiene protocols established by FSSAI for food processing, storage, or handling.

- Selling Adulterated or Misbranded Food: Selling food that does not meet the standards of quality or labeling requirements set by FSSAI.

- Not Renewing the FSSAI License: Failing to renew the food license before it expires, leading to the business operating without a valid license.

- Obstructing Food Safety Inspections: Not allowing FSSAI officials to inspect food products or business premises.

Noncompliance can lead to serious legal consequences, including fines, penalties, and imprisonment, depending on the severity of the violation.

Choosing legal tax refers to ensuring compliance with tax laws and regulations in a lawful and transparent manner. It involves paying taxes according to the guidelines established by the government, without resorting to evasion or unethical practices. Here are several key reasons why choosing legal tax is important:

- Avoid Legal Penalties: By adhering to tax laws, businesses and individuals avoid the risk of fines, penalties, and legal actions. Tax evasion or non-compliance can lead to severe financial consequences and damage to reputation.

- Promotes Transparency: Paying taxes legally promotes transparency and credibility for businesses. It builds trust with customers, investors, and regulatory authorities.

- Contributes to National Development: Legal tax payments contribute to the country’s economic development. Taxes fund government initiatives, public services, infrastructure, healthcare, and education, benefitting society as a whole.

- Tax Benefits and Deductions: Legal tax compliance allows businesses and individuals to take advantage of legitimate tax deductions, exemptions, and credits available under the law, which can help reduce the overall tax burden.

- Improves Business Reputation: A business that complies with tax laws enhances its reputation among customers, partners, and potential investors. It positions itself as a responsible entity, committed to ethical practices.

- Prevents Risk of Business Shutdown: Businesses that fail to pay taxes legally may face shutdown orders or the revocation of licenses, which can severely impact their operations. Choosing legal tax practices helps avoid such disruptions.

- Compliance with International Standards: Legal tax practices are also necessary for businesses engaging in international trade. Many countries and global organizations require proof of tax compliance for doing business across borders.

In conclusion, choosing legal tax is not only a moral and legal obligation but also a strategic decision that protects the business from risks, builds credibility, and ensures long-term sustainability.