LLP Registration Online

Starting LLP has never been this much easier. So, obtain Limited Liability Partnership Registration with us @ lowest fees assured and in the least possible time.

How to Start a Limited Liability Partnership

What is LLP Registration?

A Limited Liability Partnership (LLP) is a type of business structure governed by the Limited Liability Partnership Act, 2008. It offers limited liability protection to its partners, ensuring their personal assets are not at risk beyond their agreed contribution. An LLP requires at least two partners, one of whom must be a resident of India, having stayed in the country for at least 182 days in a year. Notably, there is no minimum capital investment required to establish an LLP, making it an attractive option for small businesses in India.

Unlike private limited companies, LLPs cannot raise funds from the public, as they are not permitted to issue equity shares. However, registering an LLP is a quick and straightforward process, which can be completed efficiently with our assistance.

One of the key advantages of an LLP over a private limited company is its reduced compliance requirements, making it a simpler and more cost-effective option for entrepreneurs.

Checklist For Llp Registration

- Minimum Two Partners:

- An LLP requires a minimum of two individuals to act as designated partners.

- There is no restriction on the maximum number of partners in an LLP.

- Resident Designated Partner:

- At least one partner must be a permanent resident of India, staying in the country for over 182 days during the previous financial year.

- Registered Address Proof:

- A valid address is mandatory for LLP registration.

- Acceptable address proof includes a utility bill (not older than two months) and a No Objection Certificate (NOC) from the owner of the premises.

- If the property is self-owned, utility bills and the Aadhaar card showing the registered address must be provided.

- Capital Requirement:

- The LLP Act, 2008, does not specify any minimum or maximum capital requirement.

- The capital contribution depends entirely on the business needs of the LLP.

- Unique Name for the LLP:

- The proposed LLP name must be unique and distinct, avoiding similarity to any existing LLP, company, or trademark.

- If assistance is needed in selecting a unique name, we are available to help you decide on a suitable name for your LLP.

Registering an LLP is a seamless process, and our team is here to guide you through each step to ensure smooth incorporation.

List Of Documents Required For LLP Registration

Genuine documentation for the registration of an LLP plays a very important role and result in faster incorporation of the Limited Liability Partnership firm. Here, we are enlisting the document which are required; valid document after self-attestation must be submitted.

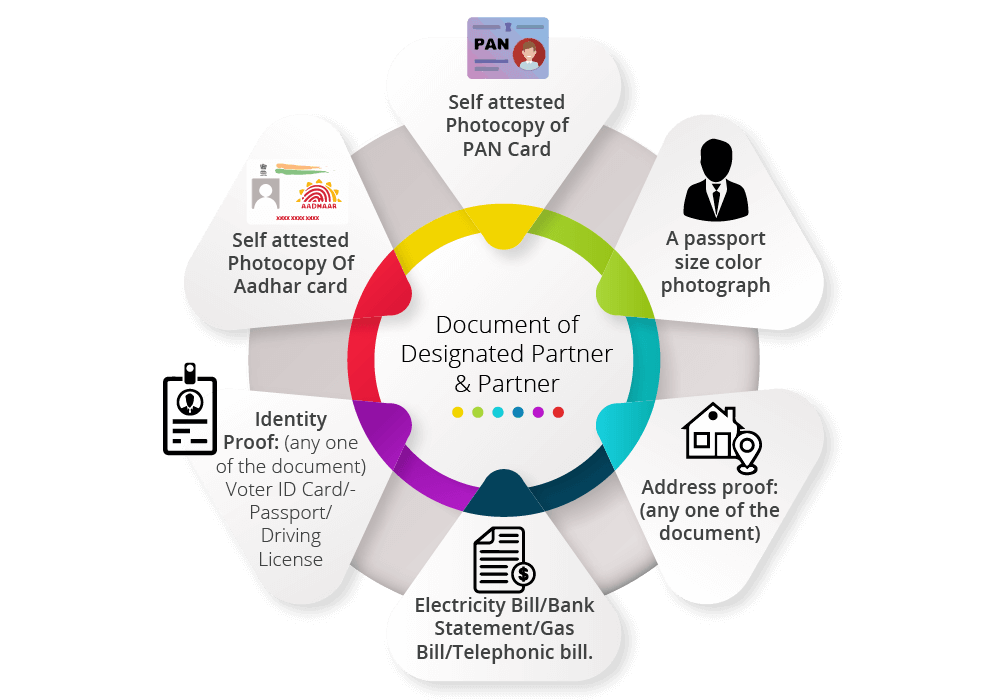

A. Document of Designated Partner & Partner

B. Document Required for Registered Address:

No objection certificate (if the address is of rental house)

Other proof : Electricity , Telephonic and water bill.

C. Legal Forms and Declaration:

Consent of Partners in Form-9

Subscriber sheet for LLP incorporation

Note : After the incorporation, the ROC issues a Certificate of Incorporation that contains the company’s address, which is available on the proof submitted for the registered address. Please ensure that the address of the premises on the NOC matches the address on the utility bill.

Process Of LLP Registration

Step 1: Documentation and Information

The LLP registration process begins with gathering the required documents of the proposed designated partners and the registered address of the LLP. It is crucial to ensure all documents are accurate and free from discrepancies to avoid delays.

Step 2: Selecting a Unique Name

Choose a name for the LLP that is unique and not identical or similar to any existing LLP, company, or trademark. Conduct a thorough check with the Registrar of Companies (ROC) and the trademark registry to prevent any infringement or rejection due to duplication.

Step 3: Digital Signature Certificate (DSC)

Digital Signature Certificates (DSCs) are required for all designated partners as they serve as the digital equivalent of physical signatures under the Information Technology Act. The registration process begins with issuing DSCs for the partners.

Step 4: Name Approval

Submit the application for LLP name approval using the FORM RUN-LLP. The chosen name must comply with ROC guidelines and trademark regulations.

Step 5: Filing for LLP Incorporation

Once the name is approved, file the application for LLP incorporation using the FILIP Form. Submit the KYC documents of the partners and proof of the registered address along with the form. The application must be attested by a practicing Chartered Accountant, Company Secretary, Cost Accountant, or a High Court Advocate. The government filing fee depends on the proposed capital contribution of the LLP.

Step 6: Issuance of Certificate of Incorporation

Upon successful verification of the application and documents, the Registrar of Companies issues the Certificate of Incorporation. This certificate serves as conclusive proof of LLP registration.

Step 7: Drafting and Filing the LLP Agreement

After incorporation, the partners must draft an LLP Agreement on stamp paper of the appropriate value (based on the respective state’s regulations). This agreement outlines the mutual rights and duties of the partners. It must be signed before a notary public and filed with the ROC in Form-3 within 30 days of incorporation.

Step 8: PAN and TAN Application

The LLP must apply for a PAN card by submitting Form 49A to the Income Tax Department. The PAN application acknowledgment is provided on the same day, and the PAN is allotted within a week. Additionally, the LLP must obtain a TAN (Tax Deduction and Collection Account Number), which is essential for complying with TDS (Tax Deducted at Source) provisions. Both PAN and TAN are mandatory for tax compliance and filing TDS returns.

This streamlined process ensures efficient registration of an LLP, enabling you to establish your business quickly and legally.

Post-incorporation Compliances

Like registration process post compliance is also very important .After LLP incorporation, you have to fill post incorporation compliance for just one time.

LLP Agreement

The LLP Agreement is a crucial document that outlines the rights and responsibilities of all partners within the LLP. It plays a vital role in ensuring harmony, avoiding disputes, and preventing future conflicts among the partners.

The agreement must be filed on the MCA portal within 30 days of the LLP’s incorporation. It should be printed on stamp paper, the value of which varies from state to state. All partners must sign the agreement to make it legally binding.

PAN and TAN Application

After the incorporation of the LLP, it is mandatory to apply for a PAN and TAN. These are essential for opening a bank account and complying with tax-related requirements. Without them, the LLP cannot perform financial transactions or file taxes.

Opening a Bank Account

Once the PAN is issued, the LLP can open a bank account in its name. This account is necessary for carrying out business-related financial transactions and managing the firm’s finances effectively.

Benefits Of LLP:

1) Easy LLP Registration Process

Registering an LLP is a straightforward and efficient process. It is quick, hassle-free, and ideal for online startups, allowing entrepreneurs to start their businesses without unnecessary delays.

2) Simplified Restructuring

The LLP Agreement governs the relationship between partners, making it easy to amend. Adding or retiring a partner is a seamless process, ensuring smooth restructuring whenever needed.

3) No Mandatory Audit for Small LLPs

As per the LLP Act, a statutory audit is not mandatory for small LLPs. However, once the annual turnover or capital contribution exceeds the specified threshold, a statutory audit by a Chartered Accountant becomes compulsory.

4) Limited Liability Protection

Partners in an LLP enjoy limited liability, meaning they are not personally responsible for the debts of the LLP. Additionally, if one partner engages in misconduct, they alone bear the consequences, and other partners are not held liable for their actions.

Disadvantages Of LLP:

- Mandatory Filing Requirements

Even if an LLP is inactive and has no business operations, it is still required to file an income tax return and an annual return with the MCA every year. Failure to comply results in heavy penalties. - Consent Required for Ownership Transfer

If a partner wishes to transfer their ownership rights, they must obtain the consent or approval of all other partners, which can make the process restrictive. - Minimum Partner Requirement

An LLP must have at least two partners at all times. If one partner decides to leave or terminates the partnership, the LLP may face dissolution, or it could dissolve automatically. - Foreign Direct Investment (FDI) Restrictions

Foreign Direct Investment in an LLP requires prior approval from the Reserve Bank of India (RBI), making it less flexible compared to other business structures.

These factors should be carefully considered when deciding to establish an LLP.

FAQ’s